MASTER IN TRADING

The New Chapter

MASTER IN TRADING

The New Chapter

MASTER IN TRADING

The New Chapter

Institutional-Grade Training to Turn Theory into Consistent Profits

Institutional-Grade Training to Turn Theory into Consistent Profits

Institutional-Grade Training to Turn Theory into Consistent Profits

Montreal | Miami | Online

Bridge the Gap Between Market Knowledge and Real-World Execution.

Montreal | Miami | Online

Bridge the Gap Between Market Knowledge and Real-World Execution.

Backed by 26-year Wall Street veteran, the Institutional Trader Blueprint™ is the only complete trader development system built to mirror how professionals generate millions annually

Apply Now

Duration

Duration

6

Month

Curriculum

Month

Curriculum

Access

Access

12

Month

Ecosystem

Month

Ecosystem

Format

Format

Hybrid

Hybrid

In-Person

& Online

In-Person

& Online

Some MIT graduates have gone on to work at

Some MIT graduates have gone on to work at

Logos are shown for informational purposes only to illustrate where graduates have worked. These institutions do not sponsor, endorse, or have any affiliation with this program.

Logos are shown for informational purposes only to illustrate where graduates have worked. These institutions do not sponsor, endorse, or have any affiliation with this program.

Logos are shown for informational purposes only to illustrate where graduates have worked. These institutions do not sponsor, endorse, or have any affiliation with this program.

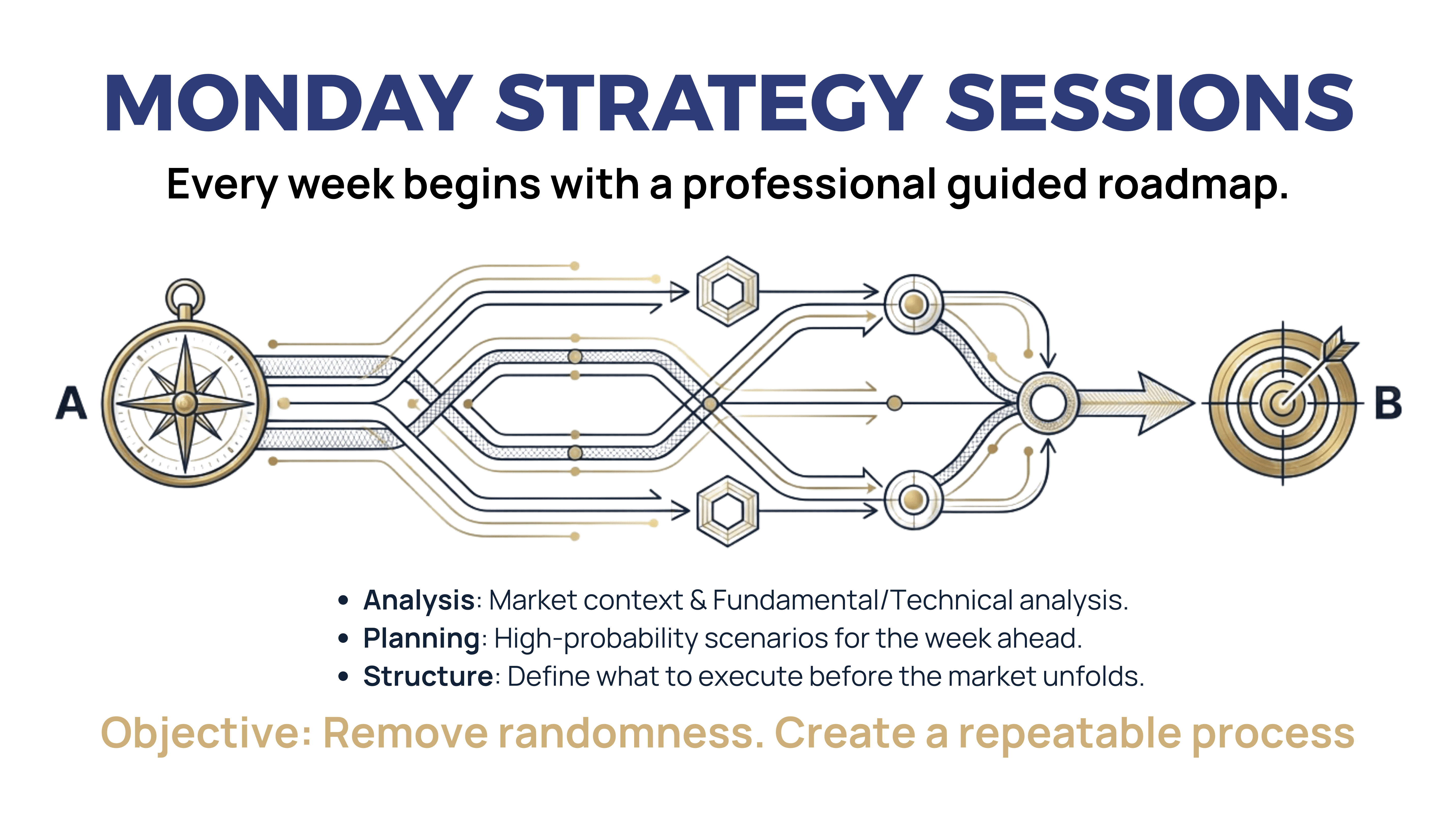

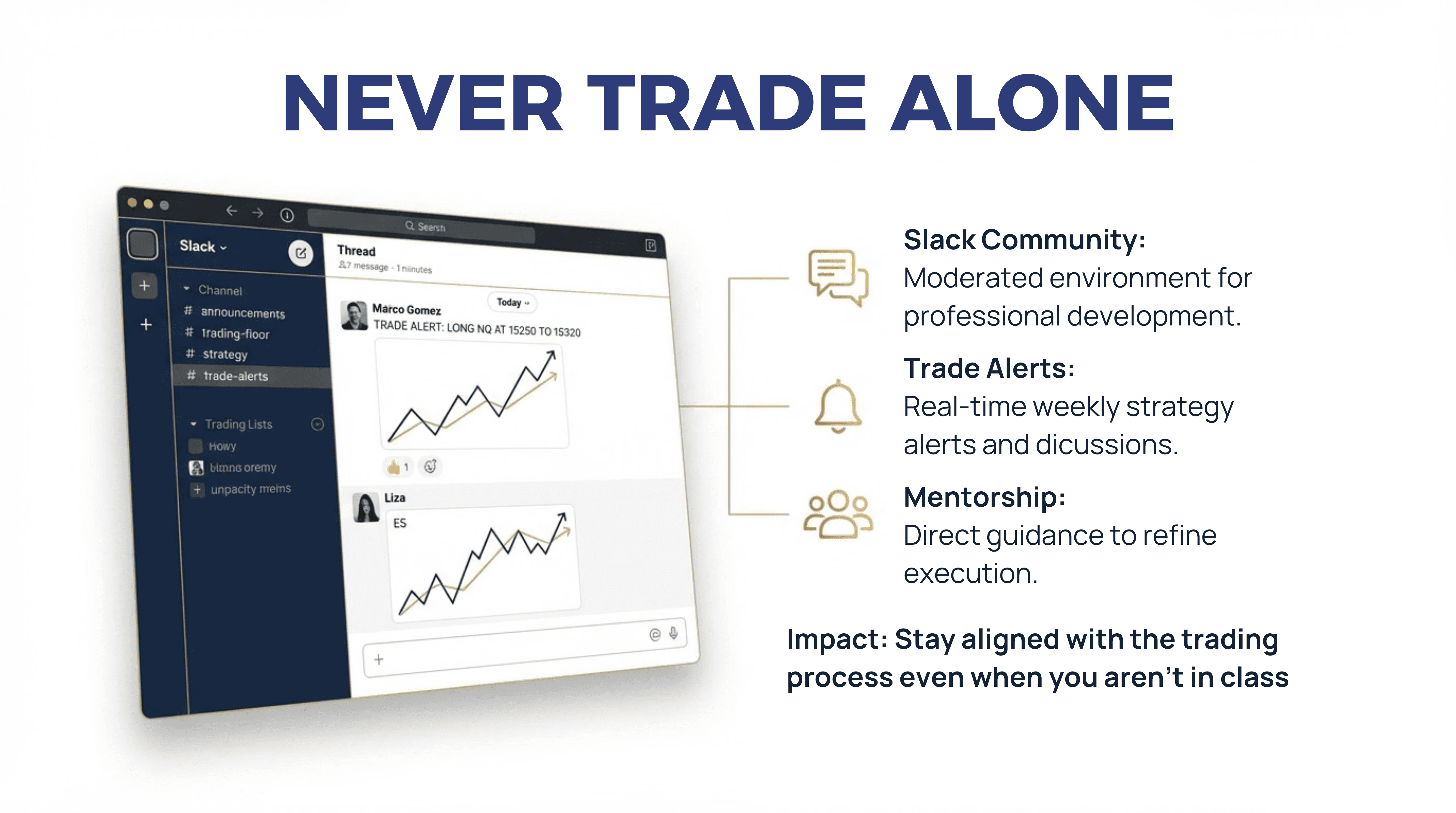

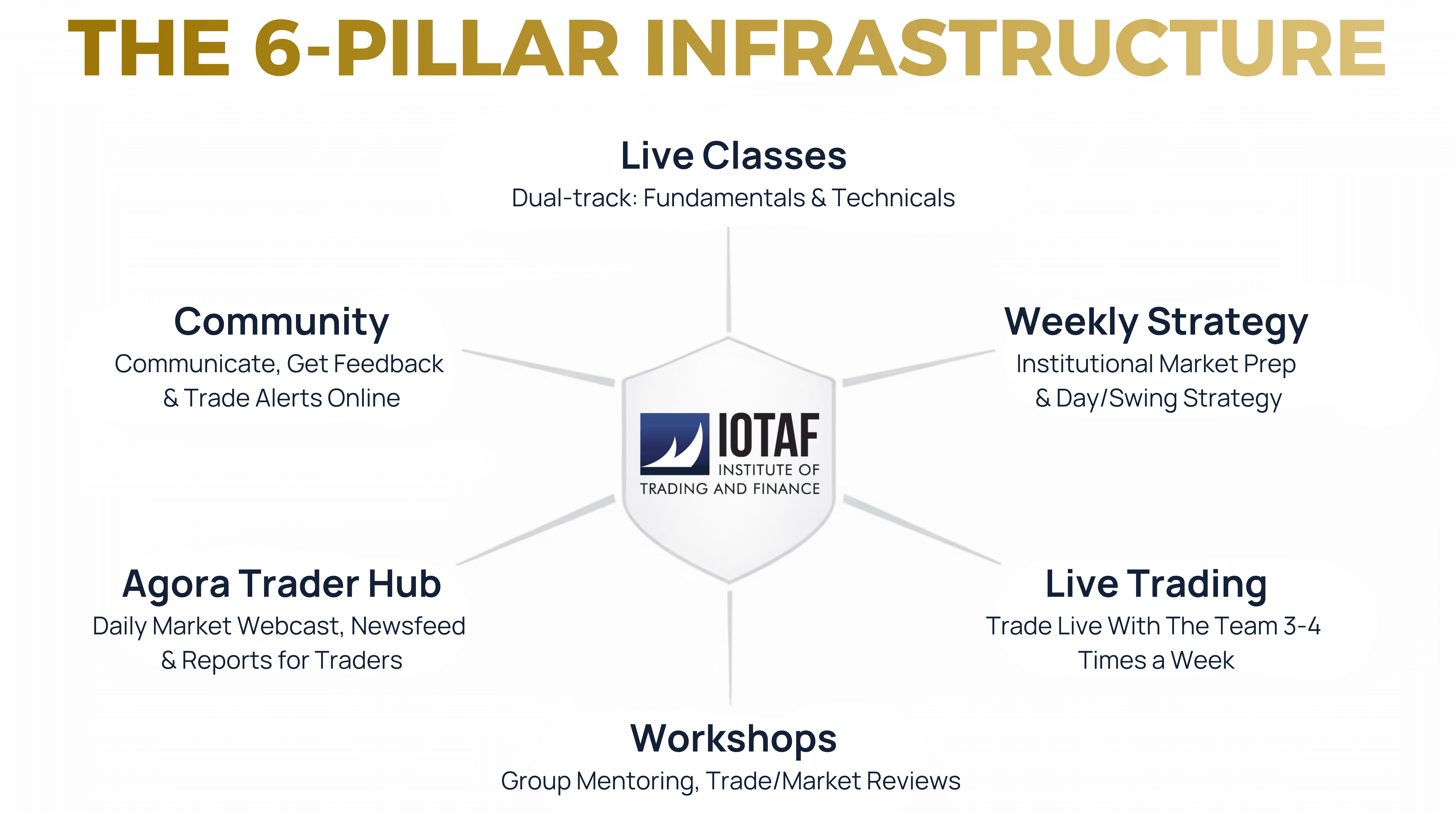

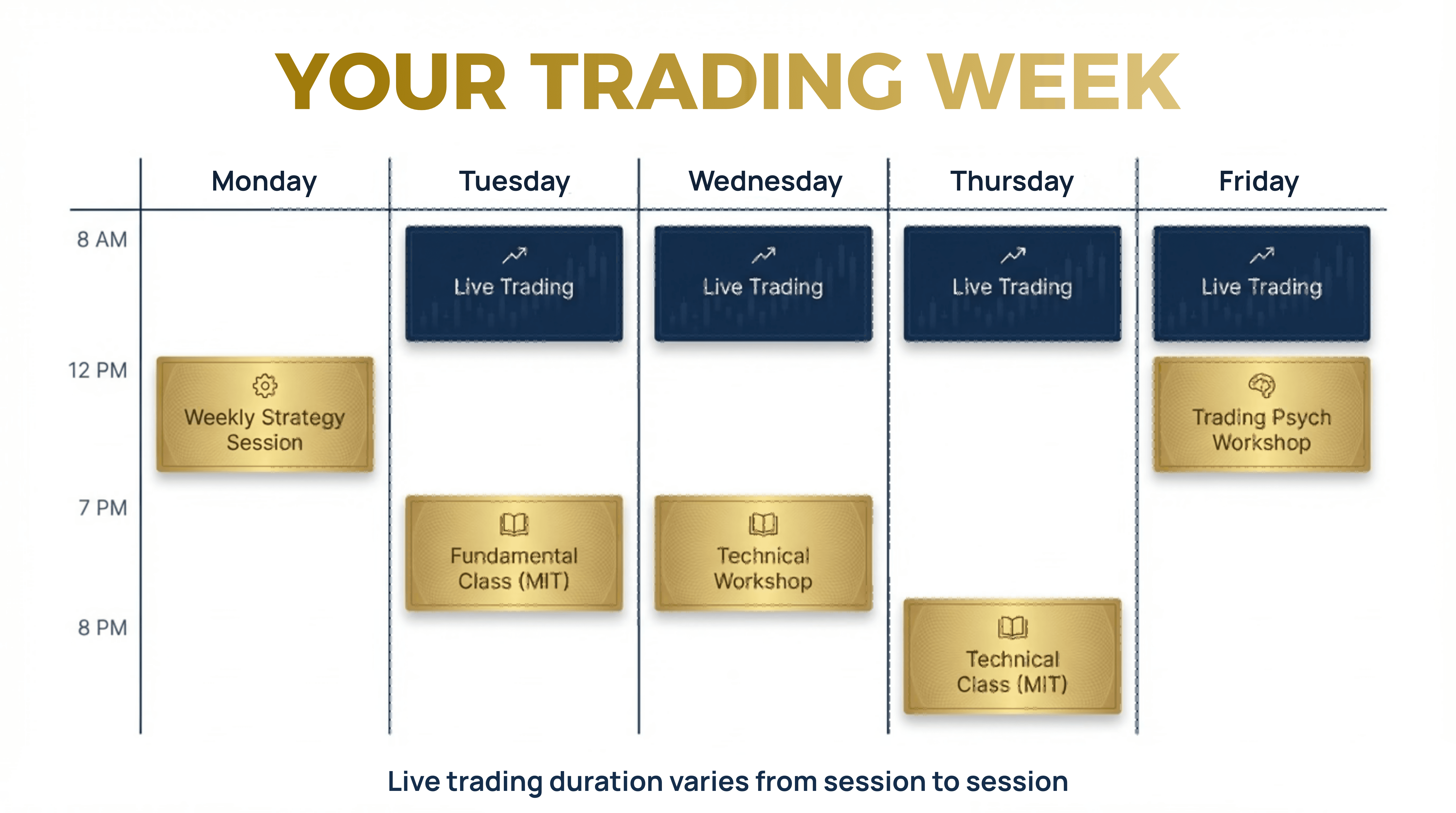

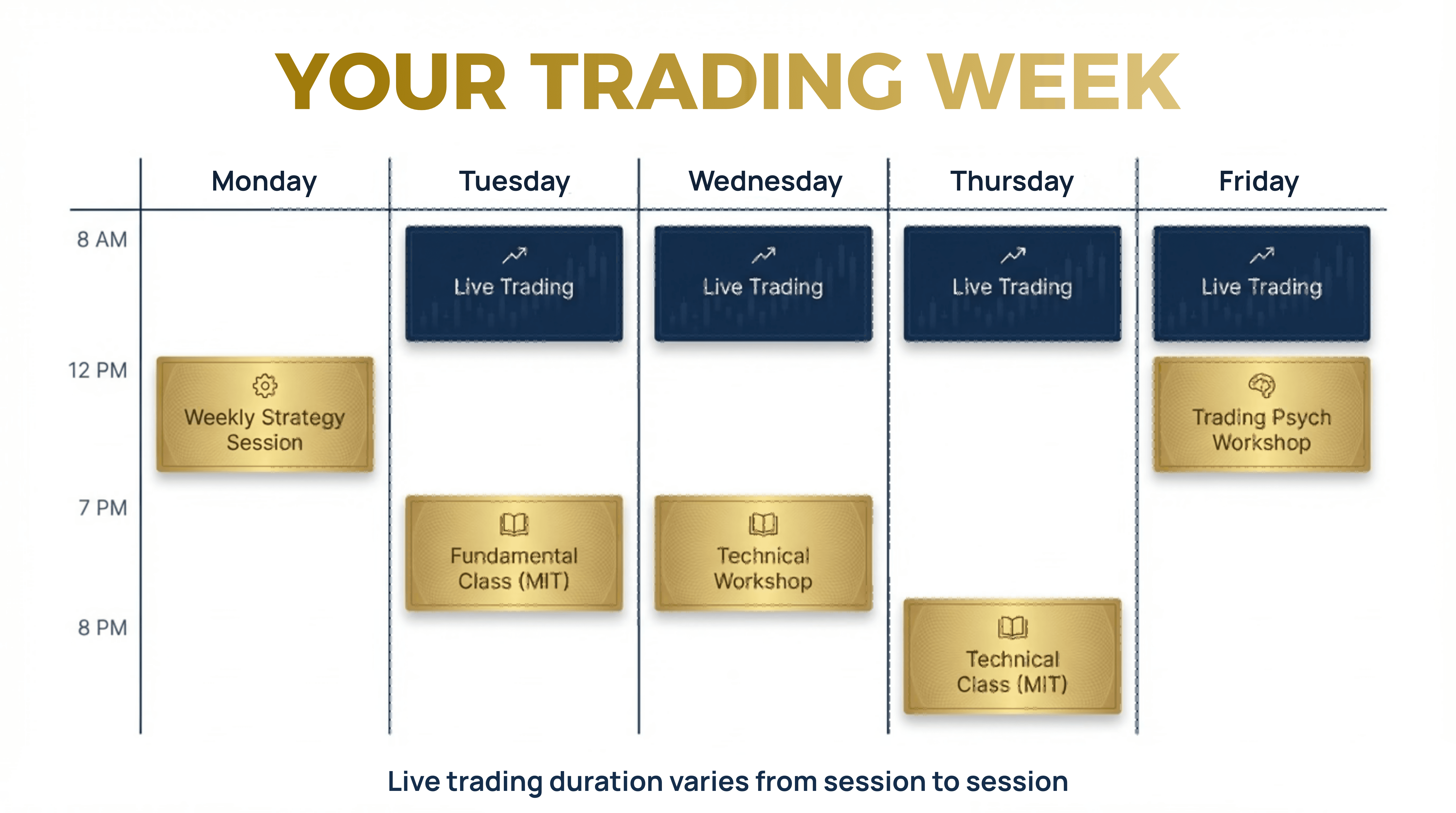

Our students learn in a real-world, hands-on environment where they build confidence, sharpen skills, and stay connected to industry professionals every single day.

Our students learn in a real-world, hands-on environment where they build confidence, sharpen skills, and stay connected to industry professionals every single day.

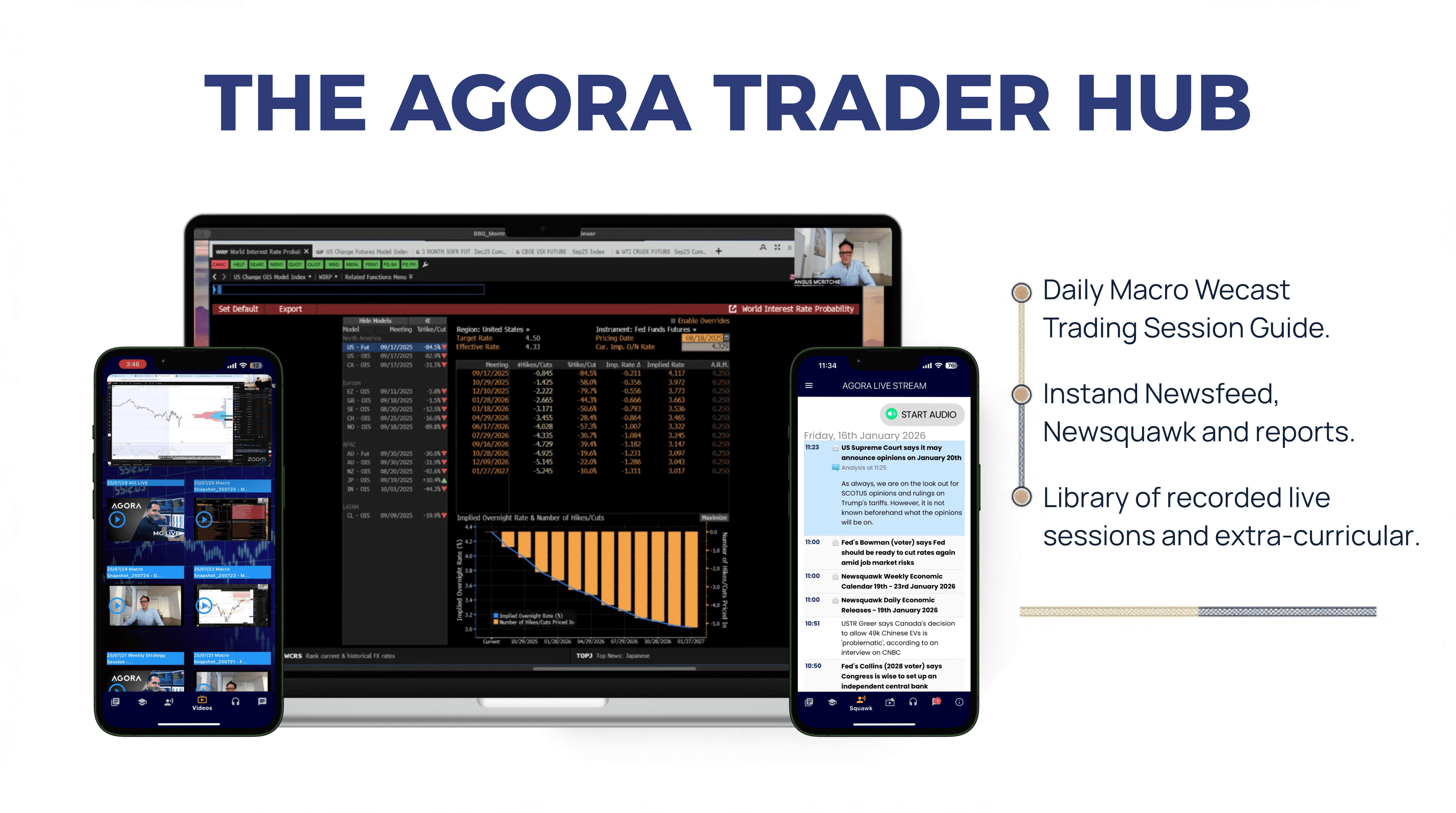

Every live event is recorded and instantly uploaded on Agora for members who cannot attend.

Every live event is recorded and instantly uploaded on Agora for members who cannot attend.

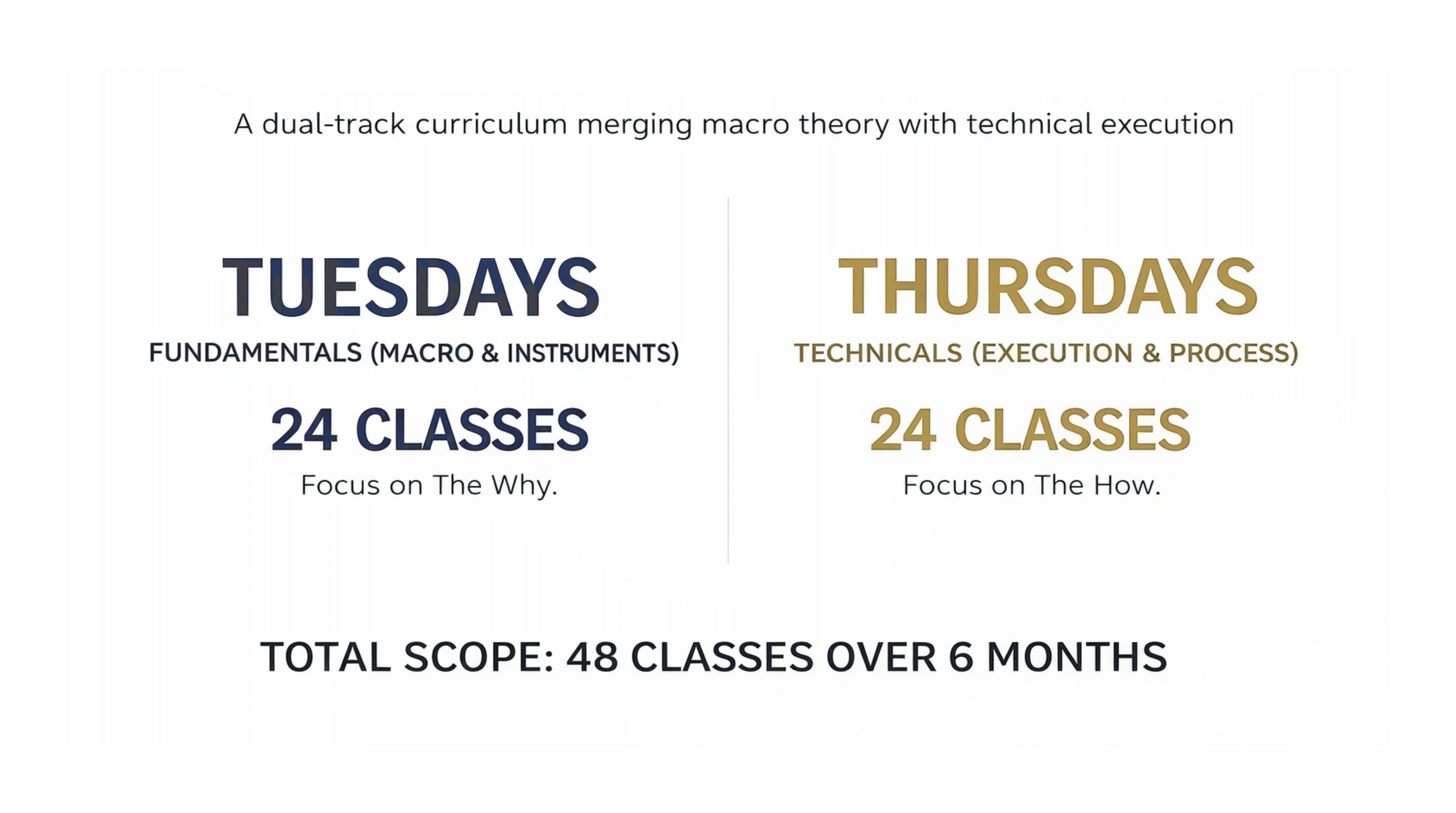

The MIT Curriculum: Fundamentals & Technicals

Our Master In Trading Curriculum

Product: Stocks, Bonds, Forex, Commodities, Crypto, Futures, Options

Timeframe: Day Trade, Swing Trade, Long-Term Investing

Style: Momentum, Reversals, Scalping, Technical, Event-Driven, Macro, News Trader, Spreads, Trend Following

/0

1

Module 1: Macro Trading & Data

‣ Introduction to trading and financial markets basics ‣ Expectation theory + quality of macro data ‣ Deep coverage of economic indicators (US & international) ‣ Central banks: Fed focus, monetary policy, and global peers ‣ News/research methods for real-time macro interpretation Click to view the full 24-class breakdown

/0

1

Module 1: Macro Trading & Data

‣ Introduction to trading and financial markets basics ‣ Expectation theory + quality of macro data ‣ Deep coverage of economic indicators (US & international) ‣ Central banks: Fed focus, monetary policy, and global peers ‣ News/research methods for real-time macro interpretation Click to view the full 24-class breakdown

/0

1

Module 1: Macro Trading & Data

‣ Introduction to trading and financial markets basics ‣ Expectation theory + quality of macro data ‣ Deep coverage of economic indicators (US & international) ‣ Central banks: Fed focus, monetary policy, and global peers ‣ News/research methods for real-time macro interpretation Click to view the full 24-class breakdown

/0

2

Module 2: Asset Classes & Correlations

‣ Exchanges, platforms, brokers, market makers, and products ‣ Stocks & ETFs + bonds/interest rates as macro weapons ‣ Commodities/energy/precious metals + forex dynamics ‣ Crypto currencies, blockchain, and futures trading mechanics ‣ Inter- and intra-market correlations for cross-asset edge Click to view the full 24-class breakdown

/0

2

Module 2: Asset Classes & Correlations

‣ Exchanges, platforms, brokers, market makers, and products ‣ Stocks & ETFs + bonds/interest rates as macro weapons ‣ Commodities/energy/precious metals + forex dynamics ‣ Crypto currencies, blockchain, and futures trading mechanics ‣ Inter- and intra-market correlations for cross-asset edge Click to view the full 24-class breakdown

/0

2

Module 2: Asset Classes & Correlations

‣ Exchanges, platforms, brokers, market makers, and products ‣ Stocks & ETFs + bonds/interest rates as macro weapons ‣ Commodities/energy/precious metals + forex dynamics ‣ Crypto currencies, blockchain, and futures trading mechanics ‣ Inter- and intra-market correlations for cross-asset edge Click to view the full 24-class breakdown

/0

3

Module 3: Options & Strategies

‣ Introduction to intermediate/advanced options + strategies ‣ Trade setups, building a trading system, and risk management ‣ Psychology, trading rules, and performance optimization ‣ Integrating macro insights into options and portfolio construction Click to view the full 24-class breakdown

/0

3

Module 3: Options & Strategies

‣ Introduction to intermediate/advanced options + strategies ‣ Trade setups, building a trading system, and risk management ‣ Psychology, trading rules, and performance optimization ‣ Integrating macro insights into options and portfolio construction Click to view the full 24-class breakdown

/0

3

Module 3: Options & Strategies

‣ Introduction to intermediate/advanced options + strategies ‣ Trade setups, building a trading system, and risk management ‣ Psychology, trading rules, and performance optimization ‣ Integrating macro insights into options and portfolio construction Click to view the full 24-class breakdown

/0

4

Module 4: Structure & Price

‣ IOTAF Trading Rules & Risk Standards as the core framework ‣ Trading 101 + Day vs. Swing Trading distinctions ‣ Candlesticks, Trends & Trendlines, Support & Resistance ‣ Market Structure, Levels/Gaps/Range, Chart Patterns ‣ Multi-Timeframe Analysis for confluence and context Click to view the full 24-class breakdown

/0

4

Module 4: Structure & Price

‣ IOTAF Trading Rules & Risk Standards as the core framework ‣ Trading 101 + Day vs. Swing Trading distinctions ‣ Candlesticks, Trends & Trendlines, Support & Resistance ‣ Market Structure, Levels/Gaps/Range, Chart Patterns ‣ Multi-Timeframe Analysis for confluence and context Click to view the full 24-class breakdown

/0

4

Module 4: Structure & Price

‣ IOTAF Trading Rules & Risk Standards as the core framework ‣ Trading 101 + Day vs. Swing Trading distinctions ‣ Candlesticks, Trends & Trendlines, Support & Resistance ‣ Market Structure, Levels/Gaps/Range, Chart Patterns ‣ Multi-Timeframe Analysis for confluence and context Click to view the full 24-class breakdown

/0

6

Module 6: Execution & Process

‣ Trade Setups, Entries/Stops/Targets ‣ Trade Management & Position Sizing, Risk-Reward & Expectancy ‣ Trading Plan Construction + Use Case Class ‣ Backtesting & Journaling, Trade Reviews & Applied Concepts ‣ Trading Psychology + Capstone: Macro Thesis to Trade Execution Click to view the full 24-class breakdown

/0

6

Module 6: Execution & Process

‣ Trade Setups, Entries/Stops/Targets ‣ Trade Management & Position Sizing, Risk-Reward & Expectancy ‣ Trading Plan Construction + Use Case Class ‣ Backtesting & Journaling, Trade Reviews & Applied Concepts ‣ Trading Psychology + Capstone: Macro Thesis to Trade Execution Click to view the full 24-class breakdown

/0

6

Module 6: Execution & Process

‣ Trade Setups, Entries/Stops/Targets ‣ Trade Management & Position Sizing, Risk-Reward & Expectancy ‣ Trading Plan Construction + Use Case Class ‣ Backtesting & Journaling, Trade Reviews & Applied Concepts ‣ Trading Psychology + Capstone: Macro Thesis to Trade Execution Click to view the full 24-class breakdown

In Person and/or Online Learning Experience

In Person and/or Online Learning Experience

Institute of Trading and Finance

Learn in 3 campuses

Montreal - Miami - Online

Learn in 3 campuses

Montreal - Miami - Online

At the Institute of Trading and Finance (IOTAF), we are building a global network of professional trading floors designed to merge digital education with real-world trading experience.

At the Institute of Trading and Finance (IOTAF), we are building a global network of professional trading floors designed to merge digital education with real-world trading experience.

Our Montreal campus features a classroom, student trading floor, and professional trading floor, immersing students in a collaborative, real-time trading environment. Whether attending daily or during key market events, students experience hands-on learning alongside professional traders.

Our new Miami campus, nestled in the heart of the Brickell financial district, offers a modern, waterfront setting that serves as a vibrant hub for learning, trading, and networking. Equipped with cutting-edge facilities, this dynamic environment fosters hands-on training and real-world application, perfect for students eager to excel.

Apply Now

From The Founder

I’ve been trading for over 26 years, and teaching for more than a decade. This isn’t just a business — it’s personal, it's a passion, it’s about giving back. I still run my own trading firm, and I’m actively in the markets every day. I believe you can’t teach trading unless you’re still doing it at the highest level yourself. That’s the standard I hold myself to.

What makes our program different is that we don’t just tell you what to do. We focus on your development — we give you the tools, the structure, and the environment to truly grow as a trader. Our goal is to help you become independent — to develop your own ideas, to think for yourself, to navigate the ups and downs with clarity.

From The Founder

I’ve been trading for over 26 years, and teaching for more than a decade. This isn’t just a business — it’s personal, it's a passion, it’s about giving back. I still run my own trading firm, and I’m actively in the markets every day. I believe you can’t teach trading unless you’re still doing it at the highest level yourself. That’s the standard I hold myself to.

What makes our program different is that we don’t just tell you what to do. We focus on your development — we give you the tools, the structure, and the environment to truly grow as a trader. Our goal is to help you become independent — to develop your own ideas, to think for yourself, to navigate the ups and downs with clarity.

Marco Gomez

Founder & Head Trader

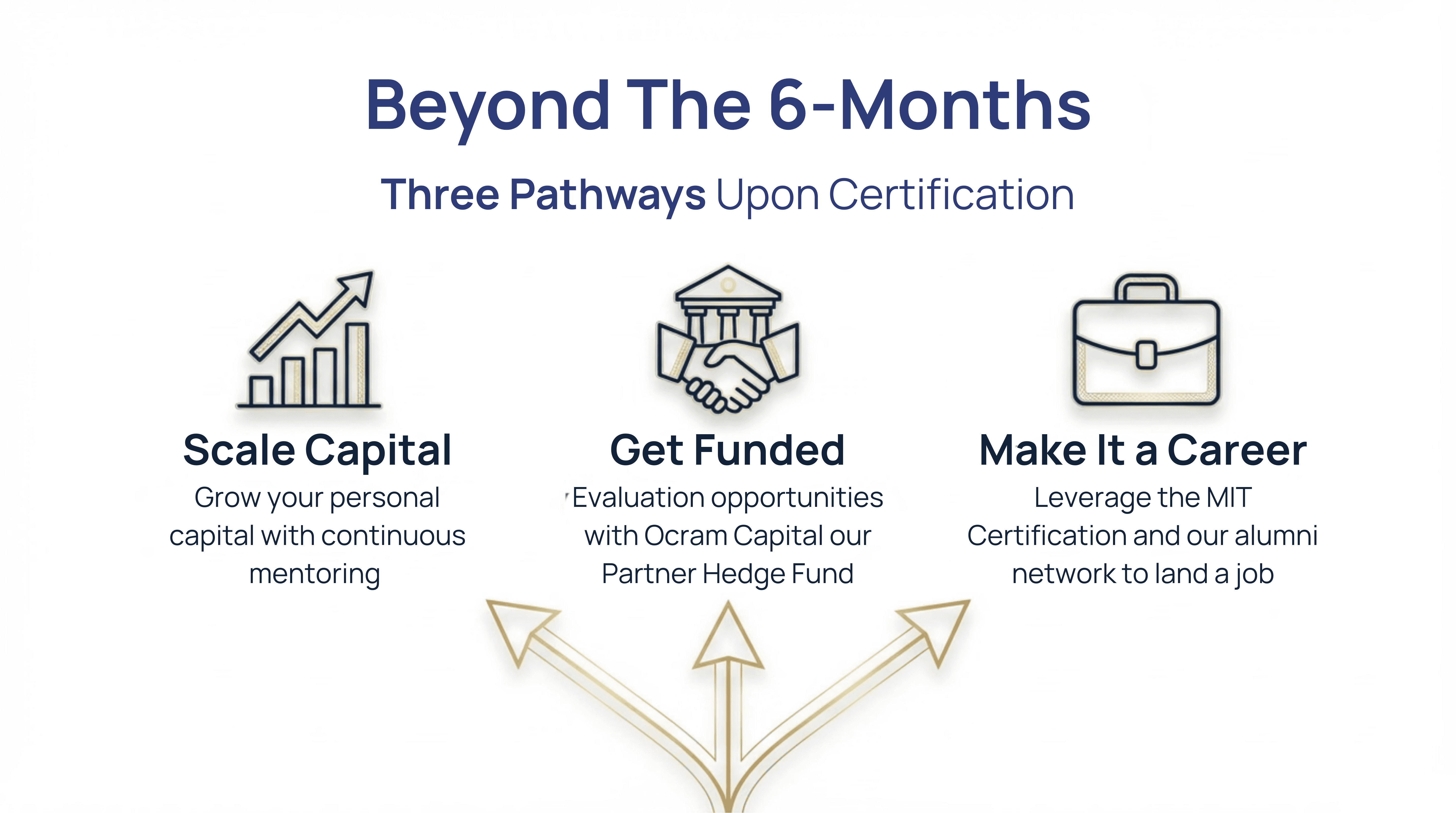

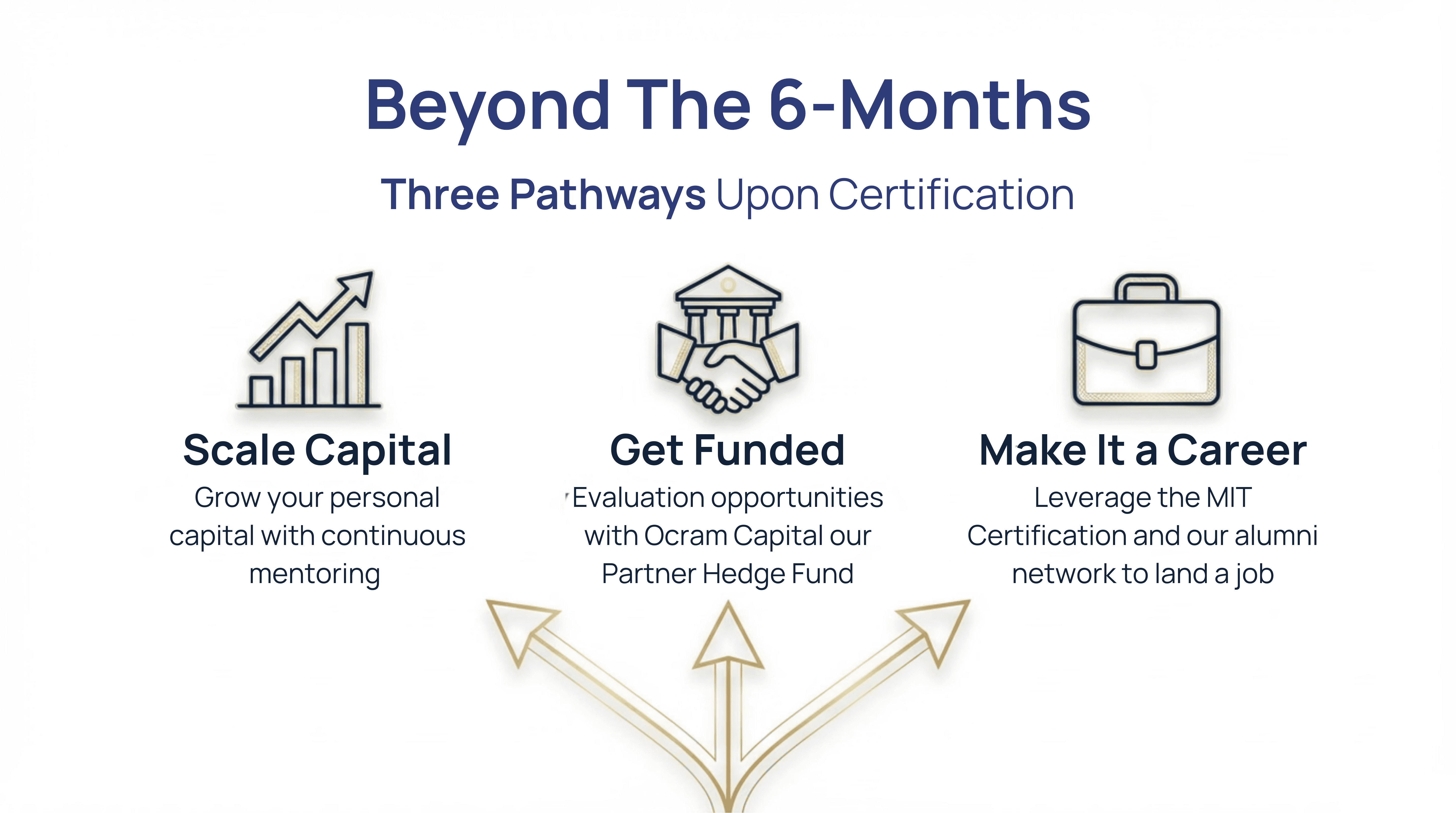

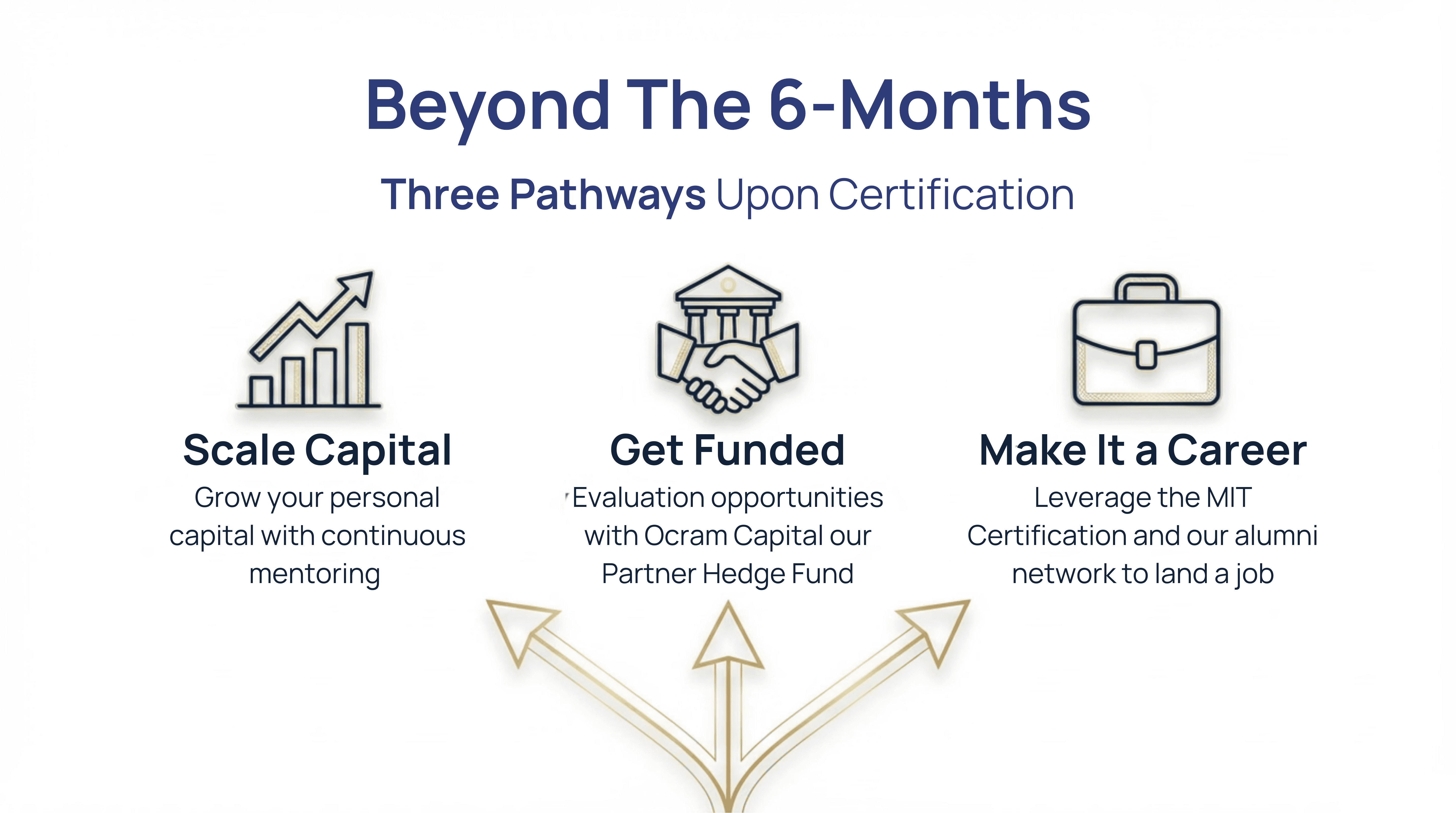

Get Funded By Our Hedge Fund

Get Funded By Our Private Hedge Fund

Earn your Master in Trading Certificate and become eligible to apply for funding directly from our hedge fund. Trade real capital. Prove your edge.

Students acquire real-world experience as they train side-by-side with a team of successful professional traders and researchers on a trading floor equipped with multi-screen stadiums, the fastest connections, and premier news services.

Earn your Master in Trading Certificate and become eligible to apply for funding directly from our hedge fund. Trade real capital.

Students acquire real-world experience as they train side-by-side with a team of successful professional traders and researchers on a trading floor equipped with multi-screen stadiums, the fastest connections, and premier news services.

Listen from our Students —more on Google

Success Stories

This program is truly exceptional for anyone looking to gain deep financial knowledge and pursue financial freedom. Learning from Marco who brings over 26 years of trading experience is an incredible privilege. Every day, I continue to grow and deepen my understanding of the markets. Any time I have a question, I know without a doubt that I’ll receive a clear and accurate answer. The value of the knowledge you acquire here is lifelong, and honestly, it’s priceless. I’m genuinely grateful for this opportunity and thank you IOTAF!!

Mathieu B

Master in Trading Graduate

The app isn’t just a great tool for learning technical and fundamental trading concepts — it also plays a crucial role in developing your mindset. It consistently challenges you to think like a professional trader, stay disciplined, and remain emotionally balanced. It’s been an invaluable resource for strengthening both my market knowledge and psychological edge.

David Gomez

Master in Trading Graduate

Life-changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff – they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M

Master in Trading Graduate

The program at IOTAF is clearly one of the best for anyone interested by the financial markets and trading. Whether you’re just getting started or you think you’re already an accomplished trader, you’ll learn tons of useful stuff from Marco and the crew of members. The Agora App is an amazing feature with all the courses and the news you want directly on your phone and will help you a lot in your journey towards trading mastery!

Noah L.

Master in Trading Student

My experience at IOTAF has exceeded all my expectations. Regardless of my lack of economic or financial background, IOTAF has not only been able to give me a strong understanding of the fundamentals but also provided me with the tools to grasp a deeper and more insightful comprehension of markets as well. Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students.

Jeremy M-B

Master in Trading Graduate

Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They have a very professional yet personable and hands-on teaching approach. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students. To me, IOTAF’s endless support, exceptional tools and expansive resources are truly unparalleled.

Vanessa N.

Master in Trading Graduate

Honestly one of the best school there is. For many years I was buying technical courses that were useless & these guys massively changed the game for me. They show you the real deal & stuff that actually work. I now myself got a community, but I’d recommend these masterminds a 100% as they’ll teach you what actual trading is & How markets truly operate. No crap miracle strategy. If you were looking for the holy grail, this is it. Their lessons & courses are logically created & the learning of what’s considered complicated is made as simple as it should be, yet still give insane results if you’re willing to put the work.

Jeremy P.

Master in Trading Graduate

Before signing up, I went to one of their open houses to learn more about the Master in Trading MIT program. Off the bat, I was impressed by the broad knowledge of the teachers about markets and how they work, but what really got me hooked was the idea of a lifetime membership in a trading community, where I can get help whenever I need it. Becoming a trader is a long process and having access to experienced mentors is reassuring. It’s been almost a year that I graduated from MIT, but thanks to the IOTAF community, I did not cease to learn new things that helped me develop my own personal approach to trading.

Adam S.

master in Trading Graduate

I am absolutely thrilled with my experience at the IOTAF trading school! If you are looking for an exceptional place to master the art of trading, look no further. The courses are incredibly enriching and presented with remarkable clarity, making learning accessible to everyone, regardless of their starting level. Moreover, the teachers are truly invested in their students success. Their passion and commitment are felt in every session, and they are always available to answer our questions and guide us. Thanks to IOTAF, I feel much more confident and competent in my trading decisions. I highly recommend this school to anyone who seriously wants to develop their skills and succeed in the world of trading. A big thank you to the entire IOTAF team for their excellent work and support !

Ariel T.

Master in Trading Graduate

This institution provides an extensive library of educational material, covering everything from macroeconomic data and monetary policy to bond auctions, intermarket correlations, Federal Reserve operations, options, futures, day trading, swing trading, portfolio management, and much more. However, what most students including me find valuable is the continuous mentorship from a seasoned trading expert with 26 years of experience. The real value begins after completing the all courses , you get to have the rare opportunity to follow up regularly via weekly strategy sessions and daily ongoing discussions about current events , you get to observe how the founder of iotaf approaches the markets , makes decisions, and refines strategies over time .

Adele B

Master in Trading Graduate

Coming into IOTAF, I already had a university degree and had taken multiple online "YouTube" trading courses, but I was still searching for a structured, realistic education in trading. IOTAF stands out because it doesn’t sell you a "get rich quick" dream like so many others do. They are upfront from the start: trading is a profession that requires real skill, discipline, and patience. The curriculum is extremely well-organized, rooted in understanding real market structure rather than relying on indicators or hype. What sets IOTAF apart is that it gives you the knowledge to truly understand how the market works, and from there, decide which trading style fits you best.

Joe S

Master in Trading Graduate

I have been part of IOTAF for multiple years and I am constantly impressed by how much I continuously learn. The teachers are some of the best in the world. And their knowledge and experience is unbeaten. They are always there to offer support when needed. Joining IOTAF is the best decision I have ever made. Would definitely recommend to anyone considering

Alessandro P

Master in Trading Graduate

As a finance graduate and currently a CFA level 3 candidate, that school provided me field experience that you don't learn in books. It teaches you how to read the market and how to trade different products and apply the knowledge ( futures, options, swing trading) on an institutional grade. They don't beat around the bush, they teach you how to make money. Plain and simple. They even have opportunities once you cleared the exam and are profitable to become funded as a prop trader in their hedge fund. ( licenses required). If you are serious about learning how to trade, are a self-learner and have discipline, I highly recommend you enroll in this program. Nobody is going to hand you a free lunch but you can seriously change your life if you put in the work. I just wished I had enroll earlier.

Felix V.

Master in Trading Graduate

I am a former student of IOTAF from 2020 and an ongoing/current member of the school, I retain my membership every year because the school delivers consistent value as there is always more to learn from the head of the school and the teachers. This is a world class trading institute and should be considered absolutely mandatory for anyone who takes their capital markets trading seriously. I recommend the school wholeheartedly as it represents one of the best investments in yourself that you can make.

Daniel C.

Master in Trading Graduate

Excellent learning experience. Incredible market insights and invaluable tools to master trading. Not an overnight miracle maker but gradual and steady teaching to develop the correct approach. Highly recommended.

Altaf S.

Master in Trading Graduate

IOTAF Trading School exceeded my expectations in every aspect. The well-designed curriculum, led by expert instructors with real-world experience, provides a comprehensive understanding of trading. The hands-on approach, including live trading sessions, bridges the gap between theory and practice. The personalized mentorship and supportive community create an ideal learning environment. IOTAF's commitment to incorporating the latest technologies sets it apart as a forward-thinking institution. Enrolling in IOTAF has proven to be a valuable investment in my trading journey, and I highly recommend it to anyone looking to excel in the financial markets."

Phil P.

Master in Trading Graduate

Life changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff - they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M.

Master in Trading Graduate

IOTAF, this school is one of a kind. The founder and its team members care about one another. They care about the success of all. Their moto is either WE succeed together or WE fail. I am impressed with the level of attention to ensuring their students when they make a mistake, how to learn from it.... Both Marco and Chien have been very helpful to me. I had practically not much knowledge about wall street and when I took their bootcamp course, it opened my eyes to a whole new world. They are so much fun to be with, not only I am learning everyday, I am actually now making some decent money. This was never in my plan. After 8 months of joining the course, I am very pleased with the small investment that I took upon myself. It is very much worthwhile.

Fabio C.

Master in Trading Graduate

I started trading penny stocks like most people. There were days I didn't understand why the markets did what they did which was really frustrating. When I joined the MIT course at IOTAF, I realized I really didn't know much. This program taught me all I needed to know. Of course, besides having the knowledge, trading is very much about risk management, patience and controlling emotions and impulses.Those who are disciplined enough succeed, those who aren't fail and blame the market or others. IOTAF has provided me with the support to improve as a trader from strategy sessions, trade analysis, risk management and much more. Definitely worth it.

Mohamed K.

Master in Trading Graduate

It all began when I've attended their open house. It took me five minutes to realize that I was standing in the best trading school in town !! Outstanding facilities in a dynamic environment!! Teachers and staff are truly passionate, experienced, 100% dedicated and share the same goal: make each and every student a knowledgeable and succesful trader!! To me, the most valuable asset is the incredible community you become part of when you join the school!! By far, the best professional decision I have ever made!! Five stars well deserved !! Tumbs up IOTAF!!

Mathieu V.

Master in Trading Graduate

This program is truly exceptional for anyone looking to gain deep financial knowledge and pursue financial freedom. Learning from Marco who brings over 26 years of trading experience is an incredible privilege. Every day, I continue to grow and deepen my understanding of the markets. Any time I have a question, I know without a doubt that I’ll receive a clear and accurate answer. The value of the knowledge you acquire here is lifelong, and honestly, it’s priceless. I’m genuinely grateful for this opportunity and thank you IOTAF!!

Mathieu B

Master in Trading Graduate

The app isn’t just a great tool for learning technical and fundamental trading concepts — it also plays a crucial role in developing your mindset. It consistently challenges you to think like a professional trader, stay disciplined, and remain emotionally balanced. It’s been an invaluable resource for strengthening both my market knowledge and psychological edge.

David Gomez

Master in Trading Graduate

Life-changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff – they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M

Master in Trading Graduate

The program at IOTAF is clearly one of the best for anyone interested by the financial markets and trading. Whether you’re just getting started or you think you’re already an accomplished trader, you’ll learn tons of useful stuff from Marco and the crew of members. The Agora App is an amazing feature with all the courses and the news you want directly on your phone and will help you a lot in your journey towards trading mastery!

Noah L.

Master in Trading Student

My experience at IOTAF has exceeded all my expectations. Regardless of my lack of economic or financial background, IOTAF has not only been able to give me a strong understanding of the fundamentals but also provided me with the tools to grasp a deeper and more insightful comprehension of markets as well. Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students.

Jeremy M-B

Master in Trading Graduate

Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They have a very professional yet personable and hands-on teaching approach. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students. To me, IOTAF’s endless support, exceptional tools and expansive resources are truly unparalleled.

Vanessa N.

Master in Trading Graduate

Honestly one of the best school there is. For many years I was buying technical courses that were useless & these guys massively changed the game for me. They show you the real deal & stuff that actually work. I now myself got a community, but I’d recommend these masterminds a 100% as they’ll teach you what actual trading is & How markets truly operate. No crap miracle strategy. If you were looking for the holy grail, this is it. Their lessons & courses are logically created & the learning of what’s considered complicated is made as simple as it should be, yet still give insane results if you’re willing to put the work.

Jeremy P.

Master in Trading Graduate

Before signing up, I went to one of their open houses to learn more about the Master in Trading MIT program. Off the bat, I was impressed by the broad knowledge of the teachers about markets and how they work, but what really got me hooked was the idea of a lifetime membership in a trading community, where I can get help whenever I need it. Becoming a trader is a long process and having access to experienced mentors is reassuring. It’s been almost a year that I graduated from MIT, but thanks to the IOTAF community, I did not cease to learn new things that helped me develop my own personal approach to trading.

Adam S.

master in Trading Graduate

I am absolutely thrilled with my experience at the IOTAF trading school! If you are looking for an exceptional place to master the art of trading, look no further. The courses are incredibly enriching and presented with remarkable clarity, making learning accessible to everyone, regardless of their starting level. Moreover, the teachers are truly invested in their students success. Their passion and commitment are felt in every session, and they are always available to answer our questions and guide us. Thanks to IOTAF, I feel much more confident and competent in my trading decisions. I highly recommend this school to anyone who seriously wants to develop their skills and succeed in the world of trading. A big thank you to the entire IOTAF team for their excellent work and support !

Ariel T.

Master in Trading Graduate

This institution provides an extensive library of educational material, covering everything from macroeconomic data and monetary policy to bond auctions, intermarket correlations, Federal Reserve operations, options, futures, day trading, swing trading, portfolio management, and much more. However, what most students including me find valuable is the continuous mentorship from a seasoned trading expert with 26 years of experience. The real value begins after completing the all courses , you get to have the rare opportunity to follow up regularly via weekly strategy sessions and daily ongoing discussions about current events , you get to observe how the founder of iotaf approaches the markets , makes decisions, and refines strategies over time .

Adele B

Master in Trading Graduate

Coming into IOTAF, I already had a university degree and had taken multiple online "YouTube" trading courses, but I was still searching for a structured, realistic education in trading. IOTAF stands out because it doesn’t sell you a "get rich quick" dream like so many others do. They are upfront from the start: trading is a profession that requires real skill, discipline, and patience. The curriculum is extremely well-organized, rooted in understanding real market structure rather than relying on indicators or hype. What sets IOTAF apart is that it gives you the knowledge to truly understand how the market works, and from there, decide which trading style fits you best.

Joe S

Master in Trading Graduate

I have been part of IOTAF for multiple years and I am constantly impressed by how much I continuously learn. The teachers are some of the best in the world. And their knowledge and experience is unbeaten. They are always there to offer support when needed. Joining IOTAF is the best decision I have ever made. Would definitely recommend to anyone considering

Alessandro P

Master in Trading Graduate

As a finance graduate and currently a CFA level 3 candidate, that school provided me field experience that you don't learn in books. It teaches you how to read the market and how to trade different products and apply the knowledge ( futures, options, swing trading) on an institutional grade. They don't beat around the bush, they teach you how to make money. Plain and simple. They even have opportunities once you cleared the exam and are profitable to become funded as a prop trader in their hedge fund. ( licenses required). If you are serious about learning how to trade, are a self-learner and have discipline, I highly recommend you enroll in this program. Nobody is going to hand you a free lunch but you can seriously change your life if you put in the work. I just wished I had enroll earlier.

Felix V.

Master in Trading Graduate

I am a former student of IOTAF from 2020 and an ongoing/current member of the school, I retain my membership every year because the school delivers consistent value as there is always more to learn from the head of the school and the teachers. This is a world class trading institute and should be considered absolutely mandatory for anyone who takes their capital markets trading seriously. I recommend the school wholeheartedly as it represents one of the best investments in yourself that you can make.

Daniel C.

Master in Trading Graduate

Excellent learning experience. Incredible market insights and invaluable tools to master trading. Not an overnight miracle maker but gradual and steady teaching to develop the correct approach. Highly recommended.

Altaf S.

Master in Trading Graduate

IOTAF Trading School exceeded my expectations in every aspect. The well-designed curriculum, led by expert instructors with real-world experience, provides a comprehensive understanding of trading. The hands-on approach, including live trading sessions, bridges the gap between theory and practice. The personalized mentorship and supportive community create an ideal learning environment. IOTAF's commitment to incorporating the latest technologies sets it apart as a forward-thinking institution. Enrolling in IOTAF has proven to be a valuable investment in my trading journey, and I highly recommend it to anyone looking to excel in the financial markets."

Phil P.

Master in Trading Graduate

Life changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff - they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M.

Master in Trading Graduate

IOTAF, this school is one of a kind. The founder and its team members care about one another. They care about the success of all. Their moto is either WE succeed together or WE fail. I am impressed with the level of attention to ensuring their students when they make a mistake, how to learn from it.... Both Marco and Chien have been very helpful to me. I had practically not much knowledge about wall street and when I took their bootcamp course, it opened my eyes to a whole new world. They are so much fun to be with, not only I am learning everyday, I am actually now making some decent money. This was never in my plan. After 8 months of joining the course, I am very pleased with the small investment that I took upon myself. It is very much worthwhile.

Fabio C.

Master in Trading Graduate

I started trading penny stocks like most people. There were days I didn't understand why the markets did what they did which was really frustrating. When I joined the MIT course at IOTAF, I realized I really didn't know much. This program taught me all I needed to know. Of course, besides having the knowledge, trading is very much about risk management, patience and controlling emotions and impulses.Those who are disciplined enough succeed, those who aren't fail and blame the market or others. IOTAF has provided me with the support to improve as a trader from strategy sessions, trade analysis, risk management and much more. Definitely worth it.

Mohamed K.

Master in Trading Graduate

It all began when I've attended their open house. It took me five minutes to realize that I was standing in the best trading school in town !! Outstanding facilities in a dynamic environment!! Teachers and staff are truly passionate, experienced, 100% dedicated and share the same goal: make each and every student a knowledgeable and succesful trader!! To me, the most valuable asset is the incredible community you become part of when you join the school!! By far, the best professional decision I have ever made!! Five stars well deserved !! Tumbs up IOTAF!!

Mathieu V.

Master in Trading Graduate

This program is truly exceptional for anyone looking to gain deep financial knowledge and pursue financial freedom. Learning from Marco who brings over 26 years of trading experience is an incredible privilege. Every day, I continue to grow and deepen my understanding of the markets. Any time I have a question, I know without a doubt that I’ll receive a clear and accurate answer. The value of the knowledge you acquire here is lifelong, and honestly, it’s priceless. I’m genuinely grateful for this opportunity and thank you IOTAF!!

Mathieu B

Master in Trading Graduate

The app isn’t just a great tool for learning technical and fundamental trading concepts — it also plays a crucial role in developing your mindset. It consistently challenges you to think like a professional trader, stay disciplined, and remain emotionally balanced. It’s been an invaluable resource for strengthening both my market knowledge and psychological edge.

David Gomez

Master in Trading Graduate

Life-changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff – they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M

Master in Trading Graduate

The program at IOTAF is clearly one of the best for anyone interested by the financial markets and trading. Whether you’re just getting started or you think you’re already an accomplished trader, you’ll learn tons of useful stuff from Marco and the crew of members. The Agora App is an amazing feature with all the courses and the news you want directly on your phone and will help you a lot in your journey towards trading mastery!

Noah L.

Master in Trading Student

My experience at IOTAF has exceeded all my expectations. Regardless of my lack of economic or financial background, IOTAF has not only been able to give me a strong understanding of the fundamentals but also provided me with the tools to grasp a deeper and more insightful comprehension of markets as well. Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students.

Jeremy M-B

Master in Trading Graduate

Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They have a very professional yet personable and hands-on teaching approach. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students. To me, IOTAF’s endless support, exceptional tools and expansive resources are truly unparalleled.

Vanessa N.

Master in Trading Graduate

Honestly one of the best school there is. For many years I was buying technical courses that were useless & these guys massively changed the game for me. They show you the real deal & stuff that actually work. I now myself got a community, but I’d recommend these masterminds a 100% as they’ll teach you what actual trading is & How markets truly operate. No crap miracle strategy. If you were looking for the holy grail, this is it. Their lessons & courses are logically created & the learning of what’s considered complicated is made as simple as it should be, yet still give insane results if you’re willing to put the work.

Jeremy P.

Master in Trading Graduate

Before signing up, I went to one of their open houses to learn more about the Master in Trading MIT program. Off the bat, I was impressed by the broad knowledge of the teachers about markets and how they work, but what really got me hooked was the idea of a lifetime membership in a trading community, where I can get help whenever I need it. Becoming a trader is a long process and having access to experienced mentors is reassuring. It’s been almost a year that I graduated from MIT, but thanks to the IOTAF community, I did not cease to learn new things that helped me develop my own personal approach to trading.

Adam S.

master in Trading Graduate

I am absolutely thrilled with my experience at the IOTAF trading school! If you are looking for an exceptional place to master the art of trading, look no further. The courses are incredibly enriching and presented with remarkable clarity, making learning accessible to everyone, regardless of their starting level. Moreover, the teachers are truly invested in their students success. Their passion and commitment are felt in every session, and they are always available to answer our questions and guide us. Thanks to IOTAF, I feel much more confident and competent in my trading decisions. I highly recommend this school to anyone who seriously wants to develop their skills and succeed in the world of trading. A big thank you to the entire IOTAF team for their excellent work and support !

Ariel T.

Master in Trading Graduate

This institution provides an extensive library of educational material, covering everything from macroeconomic data and monetary policy to bond auctions, intermarket correlations, Federal Reserve operations, options, futures, day trading, swing trading, portfolio management, and much more. However, what most students including me find valuable is the continuous mentorship from a seasoned trading expert with 26 years of experience. The real value begins after completing the all courses , you get to have the rare opportunity to follow up regularly via weekly strategy sessions and daily ongoing discussions about current events , you get to observe how the founder of iotaf approaches the markets , makes decisions, and refines strategies over time .

Adele B

Master in Trading Graduate

Coming into IOTAF, I already had a university degree and had taken multiple online "YouTube" trading courses, but I was still searching for a structured, realistic education in trading. IOTAF stands out because it doesn’t sell you a "get rich quick" dream like so many others do. They are upfront from the start: trading is a profession that requires real skill, discipline, and patience. The curriculum is extremely well-organized, rooted in understanding real market structure rather than relying on indicators or hype. What sets IOTAF apart is that it gives you the knowledge to truly understand how the market works, and from there, decide which trading style fits you best.

Joe S

Master in Trading Graduate

I have been part of IOTAF for multiple years and I am constantly impressed by how much I continuously learn. The teachers are some of the best in the world. And their knowledge and experience is unbeaten. They are always there to offer support when needed. Joining IOTAF is the best decision I have ever made. Would definitely recommend to anyone considering

Alessandro P

Master in Trading Graduate

As a finance graduate and currently a CFA level 3 candidate, that school provided me field experience that you don't learn in books. It teaches you how to read the market and how to trade different products and apply the knowledge ( futures, options, swing trading) on an institutional grade. They don't beat around the bush, they teach you how to make money. Plain and simple. They even have opportunities once you cleared the exam and are profitable to become funded as a prop trader in their hedge fund. ( licenses required). If you are serious about learning how to trade, are a self-learner and have discipline, I highly recommend you enroll in this program. Nobody is going to hand you a free lunch but you can seriously change your life if you put in the work. I just wished I had enroll earlier.

Felix V.

Master in Trading Graduate

I am a former student of IOTAF from 2020 and an ongoing/current member of the school, I retain my membership every year because the school delivers consistent value as there is always more to learn from the head of the school and the teachers. This is a world class trading institute and should be considered absolutely mandatory for anyone who takes their capital markets trading seriously. I recommend the school wholeheartedly as it represents one of the best investments in yourself that you can make.

Daniel C.

Master in Trading Graduate

Excellent learning experience. Incredible market insights and invaluable tools to master trading. Not an overnight miracle maker but gradual and steady teaching to develop the correct approach. Highly recommended.

Altaf S.

Master in Trading Graduate

IOTAF Trading School exceeded my expectations in every aspect. The well-designed curriculum, led by expert instructors with real-world experience, provides a comprehensive understanding of trading. The hands-on approach, including live trading sessions, bridges the gap between theory and practice. The personalized mentorship and supportive community create an ideal learning environment. IOTAF's commitment to incorporating the latest technologies sets it apart as a forward-thinking institution. Enrolling in IOTAF has proven to be a valuable investment in my trading journey, and I highly recommend it to anyone looking to excel in the financial markets."

Phil P.

Master in Trading Graduate

Life changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff - they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M.

Master in Trading Graduate

IOTAF, this school is one of a kind. The founder and its team members care about one another. They care about the success of all. Their moto is either WE succeed together or WE fail. I am impressed with the level of attention to ensuring their students when they make a mistake, how to learn from it.... Both Marco and Chien have been very helpful to me. I had practically not much knowledge about wall street and when I took their bootcamp course, it opened my eyes to a whole new world. They are so much fun to be with, not only I am learning everyday, I am actually now making some decent money. This was never in my plan. After 8 months of joining the course, I am very pleased with the small investment that I took upon myself. It is very much worthwhile.

Fabio C.

Master in Trading Graduate

I started trading penny stocks like most people. There were days I didn't understand why the markets did what they did which was really frustrating. When I joined the MIT course at IOTAF, I realized I really didn't know much. This program taught me all I needed to know. Of course, besides having the knowledge, trading is very much about risk management, patience and controlling emotions and impulses.Those who are disciplined enough succeed, those who aren't fail and blame the market or others. IOTAF has provided me with the support to improve as a trader from strategy sessions, trade analysis, risk management and much more. Definitely worth it.

Mohamed K.

Master in Trading Graduate

It all began when I've attended their open house. It took me five minutes to realize that I was standing in the best trading school in town !! Outstanding facilities in a dynamic environment!! Teachers and staff are truly passionate, experienced, 100% dedicated and share the same goal: make each and every student a knowledgeable and succesful trader!! To me, the most valuable asset is the incredible community you become part of when you join the school!! By far, the best professional decision I have ever made!! Five stars well deserved !! Tumbs up IOTAF!!

Mathieu V.

Master in Trading Graduate

This program is truly exceptional for anyone looking to gain deep financial knowledge and pursue financial freedom. Learning from Marco who brings over 26 years of trading experience is an incredible privilege. Every day, I continue to grow and deepen my understanding of the markets. Any time I have a question, I know without a doubt that I’ll receive a clear and accurate answer. The value of the knowledge you acquire here is lifelong, and honestly, it’s priceless. I’m genuinely grateful for this opportunity and thank you IOTAF!!

Mathieu B

Master in Trading Graduate

The app isn’t just a great tool for learning technical and fundamental trading concepts — it also plays a crucial role in developing your mindset. It consistently challenges you to think like a professional trader, stay disciplined, and remain emotionally balanced. It’s been an invaluable resource for strengthening both my market knowledge and psychological edge.

David Gomez

Master in Trading Graduate

Life-changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff – they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M

Master in Trading Graduate

The program at IOTAF is clearly one of the best for anyone interested by the financial markets and trading. Whether you’re just getting started or you think you’re already an accomplished trader, you’ll learn tons of useful stuff from Marco and the crew of members. The Agora App is an amazing feature with all the courses and the news you want directly on your phone and will help you a lot in your journey towards trading mastery!

Noah L.

Master in Trading Student

My experience at IOTAF has exceeded all my expectations. Regardless of my lack of economic or financial background, IOTAF has not only been able to give me a strong understanding of the fundamentals but also provided me with the tools to grasp a deeper and more insightful comprehension of markets as well. Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students.

Jeremy M-B

Master in Trading Graduate

Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They have a very professional yet personable and hands-on teaching approach. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students. To me, IOTAF’s endless support, exceptional tools and expansive resources are truly unparalleled.

Vanessa N.

Master in Trading Graduate

Honestly one of the best school there is. For many years I was buying technical courses that were useless & these guys massively changed the game for me. They show you the real deal & stuff that actually work. I now myself got a community, but I’d recommend these masterminds a 100% as they’ll teach you what actual trading is & How markets truly operate. No crap miracle strategy. If you were looking for the holy grail, this is it. Their lessons & courses are logically created & the learning of what’s considered complicated is made as simple as it should be, yet still give insane results if you’re willing to put the work.

Jeremy P.

Master in Trading Graduate

Before signing up, I went to one of their open houses to learn more about the Master in Trading MIT program. Off the bat, I was impressed by the broad knowledge of the teachers about markets and how they work, but what really got me hooked was the idea of a lifetime membership in a trading community, where I can get help whenever I need it. Becoming a trader is a long process and having access to experienced mentors is reassuring. It’s been almost a year that I graduated from MIT, but thanks to the IOTAF community, I did not cease to learn new things that helped me develop my own personal approach to trading.

Adam S.

master in Trading Graduate

I am absolutely thrilled with my experience at the IOTAF trading school! If you are looking for an exceptional place to master the art of trading, look no further. The courses are incredibly enriching and presented with remarkable clarity, making learning accessible to everyone, regardless of their starting level. Moreover, the teachers are truly invested in their students success. Their passion and commitment are felt in every session, and they are always available to answer our questions and guide us. Thanks to IOTAF, I feel much more confident and competent in my trading decisions. I highly recommend this school to anyone who seriously wants to develop their skills and succeed in the world of trading. A big thank you to the entire IOTAF team for their excellent work and support !

Ariel T.

Master in Trading Graduate

This institution provides an extensive library of educational material, covering everything from macroeconomic data and monetary policy to bond auctions, intermarket correlations, Federal Reserve operations, options, futures, day trading, swing trading, portfolio management, and much more. However, what most students including me find valuable is the continuous mentorship from a seasoned trading expert with 26 years of experience. The real value begins after completing the all courses , you get to have the rare opportunity to follow up regularly via weekly strategy sessions and daily ongoing discussions about current events , you get to observe how the founder of iotaf approaches the markets , makes decisions, and refines strategies over time .

Adele B

Master in Trading Graduate

Coming into IOTAF, I already had a university degree and had taken multiple online "YouTube" trading courses, but I was still searching for a structured, realistic education in trading. IOTAF stands out because it doesn’t sell you a "get rich quick" dream like so many others do. They are upfront from the start: trading is a profession that requires real skill, discipline, and patience. The curriculum is extremely well-organized, rooted in understanding real market structure rather than relying on indicators or hype. What sets IOTAF apart is that it gives you the knowledge to truly understand how the market works, and from there, decide which trading style fits you best.

Joe S

Master in Trading Graduate

I have been part of IOTAF for multiple years and I am constantly impressed by how much I continuously learn. The teachers are some of the best in the world. And their knowledge and experience is unbeaten. They are always there to offer support when needed. Joining IOTAF is the best decision I have ever made. Would definitely recommend to anyone considering

Alessandro P

Master in Trading Graduate

As a finance graduate and currently a CFA level 3 candidate, that school provided me field experience that you don't learn in books. It teaches you how to read the market and how to trade different products and apply the knowledge ( futures, options, swing trading) on an institutional grade. They don't beat around the bush, they teach you how to make money. Plain and simple. They even have opportunities once you cleared the exam and are profitable to become funded as a prop trader in their hedge fund. ( licenses required). If you are serious about learning how to trade, are a self-learner and have discipline, I highly recommend you enroll in this program. Nobody is going to hand you a free lunch but you can seriously change your life if you put in the work. I just wished I had enroll earlier.

Felix V.

Master in Trading Graduate

I am a former student of IOTAF from 2020 and an ongoing/current member of the school, I retain my membership every year because the school delivers consistent value as there is always more to learn from the head of the school and the teachers. This is a world class trading institute and should be considered absolutely mandatory for anyone who takes their capital markets trading seriously. I recommend the school wholeheartedly as it represents one of the best investments in yourself that you can make.

Daniel C.

Master in Trading Graduate

Excellent learning experience. Incredible market insights and invaluable tools to master trading. Not an overnight miracle maker but gradual and steady teaching to develop the correct approach. Highly recommended.

Altaf S.

Master in Trading Graduate

IOTAF Trading School exceeded my expectations in every aspect. The well-designed curriculum, led by expert instructors with real-world experience, provides a comprehensive understanding of trading. The hands-on approach, including live trading sessions, bridges the gap between theory and practice. The personalized mentorship and supportive community create an ideal learning environment. IOTAF's commitment to incorporating the latest technologies sets it apart as a forward-thinking institution. Enrolling in IOTAF has proven to be a valuable investment in my trading journey, and I highly recommend it to anyone looking to excel in the financial markets."

Phil P.

Master in Trading Graduate

Life changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff - they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M.

Master in Trading Graduate

IOTAF, this school is one of a kind. The founder and its team members care about one another. They care about the success of all. Their moto is either WE succeed together or WE fail. I am impressed with the level of attention to ensuring their students when they make a mistake, how to learn from it.... Both Marco and Chien have been very helpful to me. I had practically not much knowledge about wall street and when I took their bootcamp course, it opened my eyes to a whole new world. They are so much fun to be with, not only I am learning everyday, I am actually now making some decent money. This was never in my plan. After 8 months of joining the course, I am very pleased with the small investment that I took upon myself. It is very much worthwhile.

Fabio C.

Master in Trading Graduate

I started trading penny stocks like most people. There were days I didn't understand why the markets did what they did which was really frustrating. When I joined the MIT course at IOTAF, I realized I really didn't know much. This program taught me all I needed to know. Of course, besides having the knowledge, trading is very much about risk management, patience and controlling emotions and impulses.Those who are disciplined enough succeed, those who aren't fail and blame the market or others. IOTAF has provided me with the support to improve as a trader from strategy sessions, trade analysis, risk management and much more. Definitely worth it.

Mohamed K.

Master in Trading Graduate

It all began when I've attended their open house. It took me five minutes to realize that I was standing in the best trading school in town !! Outstanding facilities in a dynamic environment!! Teachers and staff are truly passionate, experienced, 100% dedicated and share the same goal: make each and every student a knowledgeable and succesful trader!! To me, the most valuable asset is the incredible community you become part of when you join the school!! By far, the best professional decision I have ever made!! Five stars well deserved !! Tumbs up IOTAF!!

Mathieu V.

Master in Trading Graduate

This program is truly exceptional for anyone looking to gain deep financial knowledge and pursue financial freedom. Learning from Marco who brings over 26 years of trading experience is an incredible privilege. Every day, I continue to grow and deepen my understanding of the markets. Any time I have a question, I know without a doubt that I’ll receive a clear and accurate answer. The value of the knowledge you acquire here is lifelong, and honestly, it’s priceless. I’m genuinely grateful for this opportunity and thank you IOTAF!!

Mathieu B

Master in Trading Graduate

The app isn’t just a great tool for learning technical and fundamental trading concepts — it also plays a crucial role in developing your mindset. It consistently challenges you to think like a professional trader, stay disciplined, and remain emotionally balanced. It’s been an invaluable resource for strengthening both my market knowledge and psychological edge.

David Gomez

Master in Trading Graduate

Before signing up, I went to one of their open houses to learn more about the Master in Trading MIT program. Off the bat, I was impressed by the broad knowledge of the teachers about markets and how they work, but what really got me hooked was the idea of a lifetime membership in a trading community, where I can get help whenever I need it. Becoming a trader is a long process and having access to experienced mentors is reassuring. It’s been almost a year that I graduated from MIT, but thanks to the IOTAF community, I did not cease to learn new things that helped me develop my own personal approach to trading.

Adam S.

master in Trading Graduate

Life-changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff – they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Eric M

Master in Trading Graduate

My experience at IOTAF has exceeded all my expectations. Regardless of my lack of economic or financial background, IOTAF has not only been able to give me a strong understanding of the fundamentals but also provided me with the tools to grasp a deeper and more insightful comprehension of markets as well. Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They have a very professional yet personable and hands-on teaching approach. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students. To me, IOTAF’s endless support, exceptional tools and expansive resources are truly unparalleled.

Jeremy M-B

Master in Trading Graduate

The program at IOTAF is clearly one of the best for anyone interested by the financial markets and trading. Whether you’re just getting started or you think you’re already an accomplished trader, you’ll learn tons of useful stuff from Marco and the crew of members. The Agora App is an amazing feature with all the courses and the news you want directly on your phone and will help you a lot in your journey towards trading mastery!

Noah L.

Master in Trading Student

Everything learnt, in theory, is then reinforced and fortified by the real-life applications of this information to the current live markets, and you quickly develop your own analysis of markets and thus eventually leading to your own style of trading. I attribute the success of the IOTAF program to the truly unique and exceptional instructors here. They have a very professional yet personable and hands-on teaching approach. They happily share their expertise, knowledge and insights as professional traders, and they are deeply committed to the success of each and every one of their students. To me, IOTAF’s endless support, exceptional tools and expansive resources are truly unparalleled.

Vanessa N.

Master in Trading Graduate

Honestly one of the best school there is. For many years I was buying technical courses that were useless & these guys massively changed the game for me. They show you the real deal & stuff that actually work. I now myself got a community, but I’d recommend these masterminds a 100% as they’ll teach you what actual trading is & How markets truly operate. No crap miracle strategy. If you were looking for the holy grail, this is it. Their lessons & courses are logically created & the learning of what’s considered complicated is made as simple as it should be, yet still give insane results if you’re willing to put the work.They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff – they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be.

Jeremy P.

Master in Trading Graduate

I am absolutely thrilled with my experience at the IOTAF trading school! If you are looking for an exceptional place to master the art of trading, look no further. The courses are incredibly enriching and presented with remarkable clarity, making learning accessible to everyone, regardless of their starting level. Moreover, the teachers are truly invested in their students success. Their passion and commitment are felt in every session, and they are always available to answer our questions and guide us. Thanks to IOTAF, I feel much more confident and competent in my trading decisions. I highly recommend this school to anyone who seriously wants to develop their skills and succeed in the world of trading. A big thank you to the entire IOTAF team for their excellent work and support !

Ariel T.

Master in Trading Graduate

This institution provides an extensive library of educational material, covering everything from macroeconomic data and monetary policy to bond auctions, intermarket correlations, Federal Reserve operations, options, futures, day trading, swing trading, portfolio management, and much more. However, what most students including me find valuable is the continuous mentorship from a seasoned trading expert with 26 years of experience. The real value begins after completing the all courses , you get to have the rare opportunity to follow up regularly via weekly strategy sessions and daily ongoing discussions about current events , you get to observe how the founder of iotaf approaches the markets , makes decisions, and refines strategies over time . The knowledge gained there is priceless—not only in terms of skills but also in learning how to think and act like a professional .

Adele B

Master in Trading Graduate

Coming into IOTAF, I already had a university degree and had taken multiple online "YouTube" trading courses, but I was still searching for a structured, realistic education in trading. IOTAF stands out because it doesn’t sell you a "get rich quick" dream like so many others do. They are upfront from the start: trading is a profession that requires real skill, discipline, and patience. The curriculum is extremely well-organized, rooted in understanding real market structure rather than relying on indicators or hype. What sets IOTAF apart is that it gives you the knowledge to truly understand how the market works, and from there, decide which trading style fits you best. For me personally, I’m gravitating toward trading futures and options. Thanks to IOTAF, I now have a strong foundation to build on, and a clear sense of direction. If you're serious about learning trading the right way and willing to put in the work, IOTAF is absolutely worth it.

Joe S

Master in Trading Graduate

I have been part of IOTAF for multiple years and I am constantly impressed by how much I continuously learn. The teachers are some of the best in the world. And their knowledge and experience is unbeaten. They are always there to offer support when needed. Joining IOTAF is the best decision I have ever made. Would definitely recommend to anyone considering

Alessandro P

Master in Trading Graduate

As a finance graduate and currently a CFA level 3 candidate, that school provided me field experience that you don't learn in books. It teaches you how to read the market and how to trade different products and apply the knowledge ( futures, options, swing trading) on an institutional grade. They don't beat around the bush, they teach you how to make money. Plain and simple. They even have opportunities once you cleared the exam and are profitable to become funded as a prop trader in their hedge fund. ( licenses required). If you are serious about learning how to trade, are a self-learner and have discipline, I highly recommend you enroll in this program. Nobody is going to hand you a free lunch but you can seriously change your life if you put in the work. I just wished I had enroll earlier. Would have saved me many blownout accounts. See this as an investment in you and your future. Feel free to contact me if you have any questions before enrolling.

Felix V.

Master in Trading Graduate

I am a former student of IOTAF from 2020 and an ongoing/current member of the school, I retain my membership every year because the school delivers consistent value as there is always more to learn from the head of the school and the teachers. This is a world class trading institute and should be considered absolutely mandatory for anyone who takes their capital markets trading seriously. I recommend the school wholeheartedly as it represents one of the best investments in yourself that you can make.

Daniel C.

Master in Trading Graduate

Excellent learning experience. Incredible market insights and invaluable tools to master trading. Not an overnight miracle maker but gradual and steady teaching to develop the correct approach. Highly recommended.

Altaf S.

Master in Trading Graduate

IOTAF Trading School exceeded my expectations in every aspect. The well-designed curriculum, led by expert instructors with real-world experience, provides a comprehensive understanding of trading. The hands-on approach, including live trading sessions, bridges the gap between theory and practice. The personalized mentorship and supportive community create an ideal learning environment. IOTAF's commitment to incorporating the latest technologies sets it apart as a forward-thinking institution. Enrolling in IOTAF has proven to be a valuable investment in my trading journey, and I highly recommend it to anyone looking to excel in the financial markets."

Phil P.

Master in Trading Graduate

Life changing course (MIT program). You are taught everything you need to know to trade like a professional. I spent about a year trying to learn from various online courses and video tutorials but they will not teach you what you learn at IOTAF. Not only are you taught the proper technical and fundamental knowledge but also the proper risk management skills that will turn you from a fish into a shark. They also have a ton of awesome resources available for students and traders alike. Their best resource though is the teaching staff - they are all expert traders that have been profitable in the business for years (decades for some). They are all ready and willing to mentor you so that you can become the trader you want to be. Highly recommended.

Eric M.

Master in Trading Graduate

IOTAF, this school is one of a kind. The founder and its team members care about one another. They care about the success of all. Their moto is either WE succeed together or WE fail. I am impressed with the level of attention to ensuring their students when they make a mistake, how to learn from it.... Both Marco and Chien have been very helpful to me. I had practically not much knowledge about wall street and when I took their bootcamp course, it opened my eyes to a whole new world. They are so much fun to be with, not only I am learning everyday, I am actually now making some decent money. This was never in my plan. After 8 months of joining the course, I am very pleased with the small investment that I took upon myself. It is very much worthwhile. I referred two of my family members last January and they have similar feeling like mine. It is a school with so much potential. They really want to have the best successful traders and most profitable worldwide one day. That is their aim. It is not the number of students they can attract, it is what these students can become.

Fabio C.

Master in Trading Graduate

I started trading penny stocks like most people. There were days I didn't understand why the markets did what they did which was really frustrating. When I joined the MIT course at IOTAF, I realized I really didn't know much. This program taught me all I needed to know. Of course, besides having the knowledge, trading is very much about risk management, patience and controlling emotions and impulses.Those who are disciplined enough succeed, those who aren't fail and blame the market or others. IOTAF has provided me with the support to improve as a trader from strategy sessions, trade analysis, risk management and much more. Definitely worth it.

Mohamed K.

Master in Trading Graduate