Application only. In-Person & Online Program

LOCATED IN

BRICKELL

MIAMI

Finally Here | 6-Month Curriculum | 12-Month Access

Application only. In-Person & Online Program

LOCATED IN

BRICKELL

MIAMI

Finally Here | 6-Month Curriculum | 12-Month Access

Application only. In-Person & Online Program

LOCATED IN

BRICKELL

MIAMI

Finally Here | 6-Month Curriculum | 12-Month Access

- Loading price…V

- Loading price…AMZN

- Loading price…NVDA

- Loading price…UNH

- Loading price…META

- Loading price…GS

- Loading price…V

- Loading price…AMZN

- Loading price…NVDA

- Loading price…UNH

- Loading price…META

- Loading price…GS

- Loading price…V

- Loading price…AMZN

- Loading price…NVDA

- Loading price…UNH

- Loading price…META

- Loading price…GS

- Loading price…MSFT

- Loading price…TSLA

- Loading price…GS

- Loading price…INTC

- Loading price…IBIT

- Loading price…MARA

- Loading price…MSFT

- Loading price…TSLA

- Loading price…GS

- Loading price…INTC

- Loading price…IBIT

- Loading price…MARA

- Loading price…MSFT

- Loading price…TSLA

- Loading price…GS

- Loading price…INTC

- Loading price…IBIT

- Loading price…MARA

Application only. In-Person Program

LOCATED IN

BRICKELL

MIAMI

Launch Your Trading Career in the Heart

of Finance

MIT Miami

Launch Your Trading Career in the Heart

of Finance

MIT Miami

Launch Your Trading Career in the Heart

of Finance

MIT Miami

Join IOTAF's First In-Person Master in Trading (MIT) Program in Vibrant Brickell, Miami.

Immerse Yourself in a 6-Month Structure Curriculum.

12-Month Access to our Trading Floors, Agora Trader Hub, Strategy/Alerts & Community.

LIMITED TO 20 STUDENTS PER COHORT

Logos are shown for informational purposes only to illustrate where graduates have worked. These institutions do not sponsor, endorse, or have any affiliation with this program.

Logos are shown for informational purposes only to illustrate where graduates have worked. These institutions do not sponsor, endorse, or have any affiliation with this program.

Logos are shown for informational purposes only to illustrate where graduates have worked. These institutions do not sponsor, endorse, or have any affiliation with this program.

In Person Learning Experience

Program Overview

Program

Overview

Duration: 6 Months

Format: Hybrid at Brickell Trading Floor

Class Size: Maximum 20 Students

Price: $3,250

Duration: 3 Months

(4 Cohorts Per Year)

Format: In-Person at Miami Campus

Class Size: Maximum 20 Students

Price: $3,250

Whats Included in MIT MIAMI

Core Program (3 Months - Flexible Commitment)

2 Live Classes Per Week (Tuesday & Thursday, 7-9 PM)

The only mandatory sessions – 4hrs total per week, fit for busy schedules.

Weekly Strategy Session (Monday 12 PM)

Optional but high-impact – Marco Gomez breaks down the week’s best setups.

WHAT'S INCLUDED

Core Program (3 Months - Flexible)

2 Live Classes Per Week

(Tuesday & Thursday, 7-9 PM)The only mandatory sessions – 4hrs total per week, fit for busy schedules.

Weekly Strategy Session

(Monday 12 PM)Optional but high-impact – MG breaks down the week’s best setups.

Bonuses (All Optional – Use What Fits Your Life)

→ Q&A and Workshops (Wednesday/Friday – open drop-in)

→ Live Trading Floor Access (Daily, 9 AM–3 PM)

→ Walk in anytime to shadow Ocram’s head trader, watch real positions.

→ 12-Month AGORA Platform Access

→ Real-time signals, newsfeeds, and community.

Bonuses

(All Optional – Use What Fits Your Life)

→ Q&A Sessions (Wednesday/Friday – open drop-in)

→ Live Trading Floor Access (Daily, 9 AM–5 PM)

→ Walk in anytime to shadow Ocram’s head trader, watch real positions.

→ 12-Month AGORA Platform Access

→ Real-time signals, newsfeeds, and community – use on your phone, anytime.

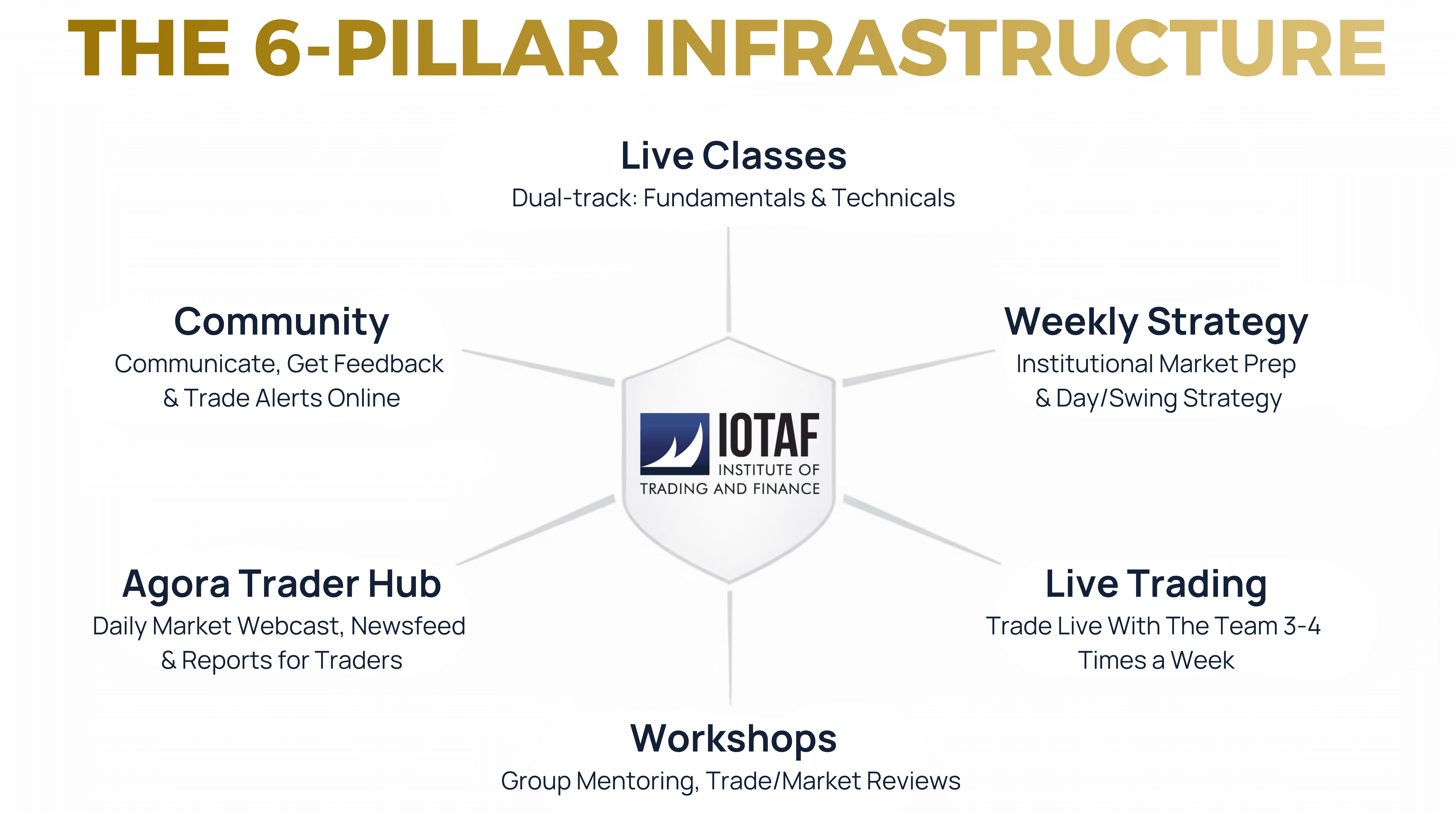

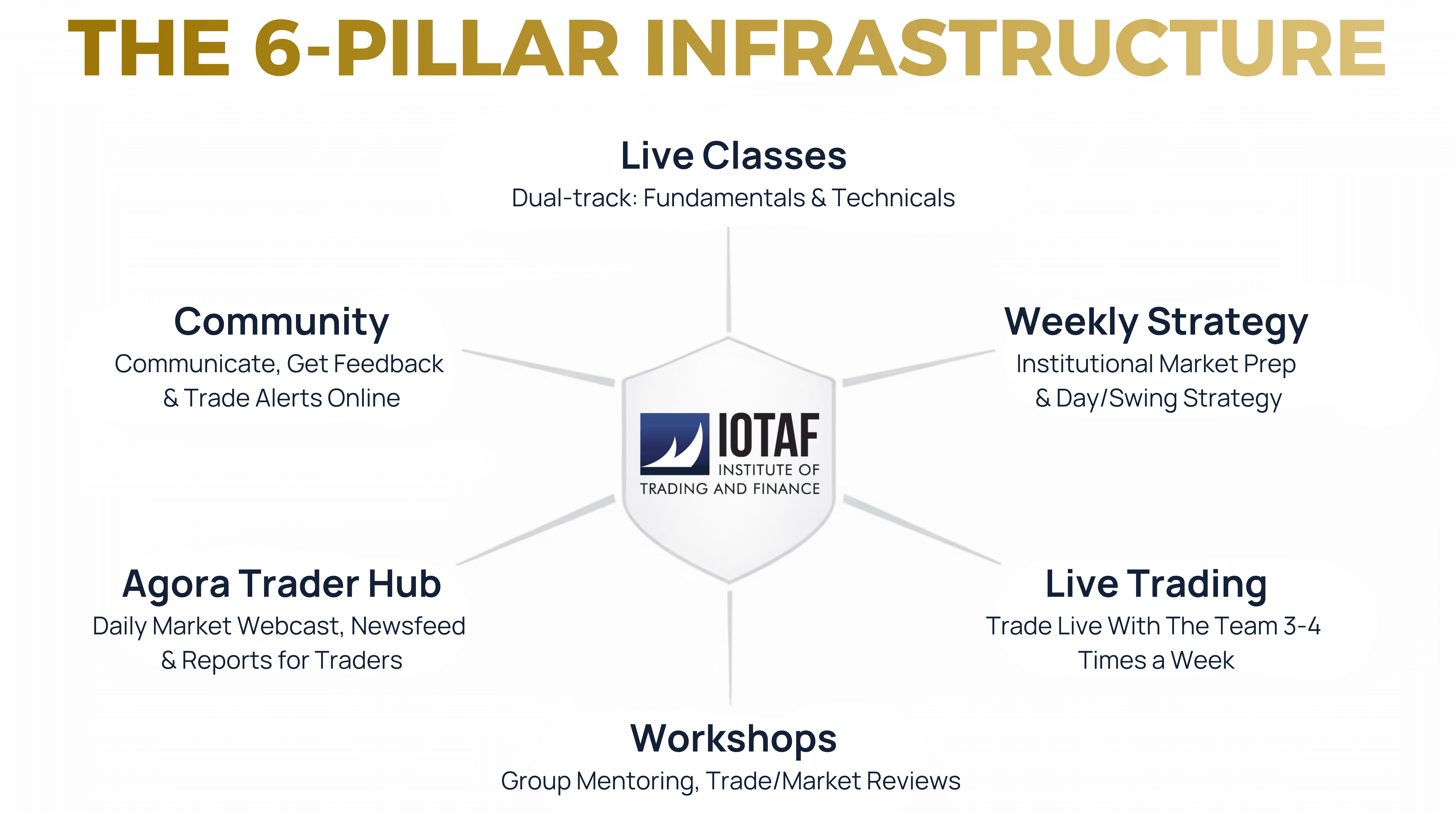

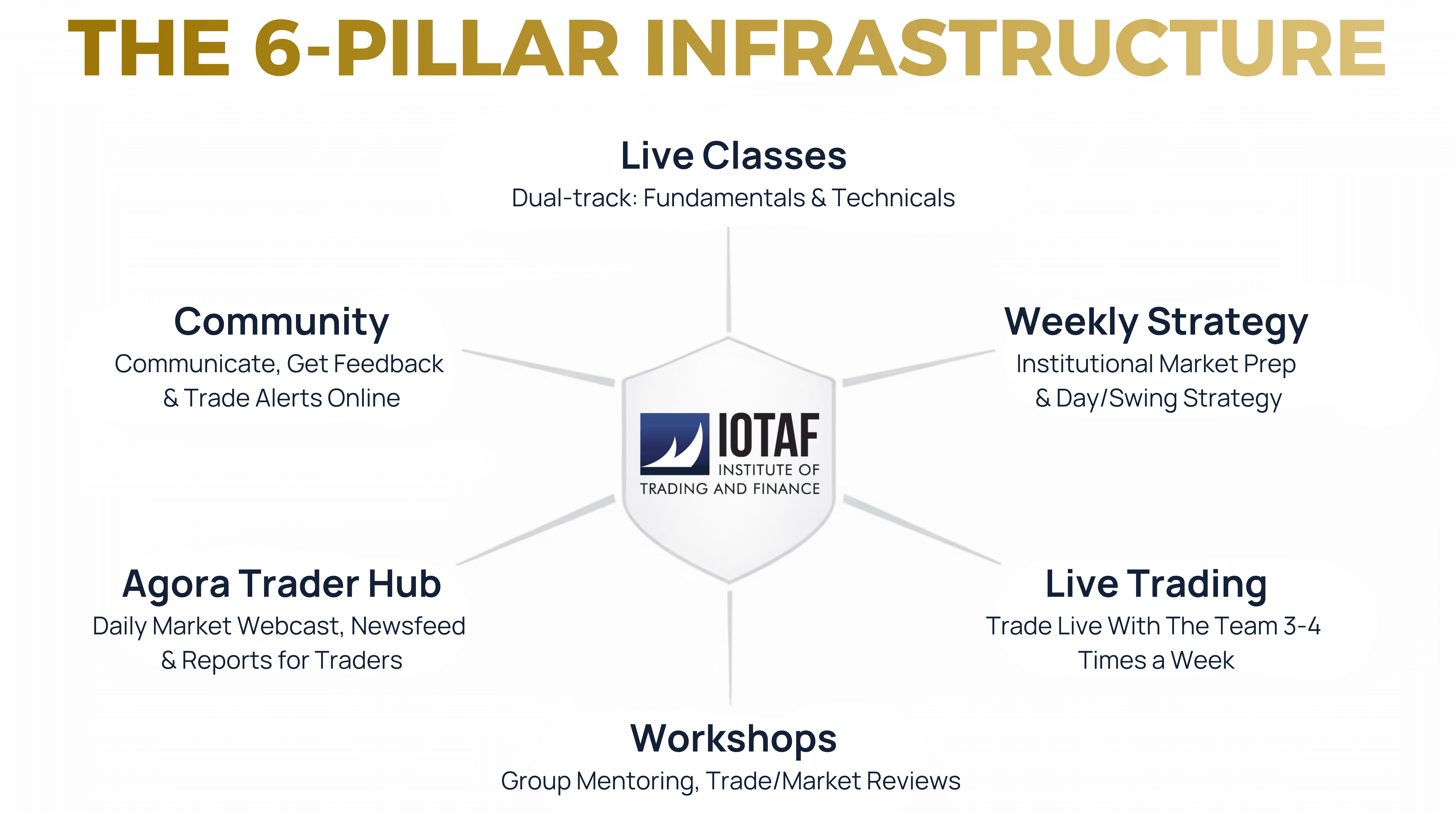

Our 6-Pillar Infrastructure

Our 6-Pillar Infrastructure

Why MIT Miami?– Only for Those Who Have What It Takes

Why MIT Miami?– Only for Those Who Have What It Takes

Our Foundation

Curriculum: Futures, Options, CFD & Spot

/0

1

Module 1: Macro Trading & Data

‣ Introduction to trading and financial markets basics ‣ Expectation theory + quality of macro data ‣ Deep coverage of economic indicators (US & international) ‣ Central banks: Fed focus, monetary policy, and global peers ‣ News/research methods for real-time macro interpretation Click to view the full 24-class breakdown

/0

1

Module 1: Macro Trading & Data

‣ Introduction to trading and financial markets basics ‣ Expectation theory + quality of macro data ‣ Deep coverage of economic indicators (US & international) ‣ Central banks: Fed focus, monetary policy, and global peers ‣ News/research methods for real-time macro interpretation Click to view the full 24-class breakdown

/0

1

Module 1: Macro Trading & Data

‣ Introduction to trading and financial markets basics ‣ Expectation theory + quality of macro data ‣ Deep coverage of economic indicators (US & international) ‣ Central banks: Fed focus, monetary policy, and global peers ‣ News/research methods for real-time macro interpretation Click to view the full 24-class breakdown

/0

2

Module 2: Asset Classes & Correlations

‣ Exchanges, platforms, brokers, market makers, and products ‣ Stocks & ETFs + bonds/interest rates as macro weapons ‣ Commodities/energy/precious metals + forex dynamics ‣ Crypto currencies, blockchain, and futures trading mechanics ‣ Inter- and intra-market correlations for cross-asset edge Click to view the full 24-class breakdown

/0

2

Module 2: Asset Classes & Correlations

‣ Exchanges, platforms, brokers, market makers, and products ‣ Stocks & ETFs + bonds/interest rates as macro weapons ‣ Commodities/energy/precious metals + forex dynamics ‣ Crypto currencies, blockchain, and futures trading mechanics ‣ Inter- and intra-market correlations for cross-asset edge Click to view the full 24-class breakdown

/0

2

Module 2: Asset Classes & Correlations

‣ Exchanges, platforms, brokers, market makers, and products ‣ Stocks & ETFs + bonds/interest rates as macro weapons ‣ Commodities/energy/precious metals + forex dynamics ‣ Crypto currencies, blockchain, and futures trading mechanics ‣ Inter- and intra-market correlations for cross-asset edge Click to view the full 24-class breakdown

/0

3

Module 3: Options & Strategies

‣ Introduction to intermediate/advanced options + strategies ‣ Trade setups, building a trading system, and risk management ‣ Psychology, trading rules, and performance optimization ‣ Integrating macro insights into options and portfolio construction Click to view the full 24-class breakdown

/0

3

Module 3: Options & Strategies

‣ Introduction to intermediate/advanced options + strategies ‣ Trade setups, building a trading system, and risk management ‣ Psychology, trading rules, and performance optimization ‣ Integrating macro insights into options and portfolio construction Click to view the full 24-class breakdown

/0

3

Module 3: Options & Strategies

‣ Introduction to intermediate/advanced options + strategies ‣ Trade setups, building a trading system, and risk management ‣ Psychology, trading rules, and performance optimization ‣ Integrating macro insights into options and portfolio construction Click to view the full 24-class breakdown

/0

4

Module 4: Structure & Price

‣ IOTAF Trading Rules & Risk Standards as the core framework ‣ Trading 101 + Day vs. Swing Trading distinctions ‣ Candlesticks, Trends & Trendlines, Support & Resistance ‣ Market Structure, Levels/Gaps/Range, Chart Patterns ‣ Multi-Timeframe Analysis for confluence and context Click to view the full 24-class breakdown

/0

4

Module 4: Structure & Price

‣ IOTAF Trading Rules & Risk Standards as the core framework ‣ Trading 101 + Day vs. Swing Trading distinctions ‣ Candlesticks, Trends & Trendlines, Support & Resistance ‣ Market Structure, Levels/Gaps/Range, Chart Patterns ‣ Multi-Timeframe Analysis for confluence and context Click to view the full 24-class breakdown

/0

4

Module 4: Structure & Price

‣ IOTAF Trading Rules & Risk Standards as the core framework ‣ Trading 101 + Day vs. Swing Trading distinctions ‣ Candlesticks, Trends & Trendlines, Support & Resistance ‣ Market Structure, Levels/Gaps/Range, Chart Patterns ‣ Multi-Timeframe Analysis for confluence and context Click to view the full 24-class breakdown

/0

6

Module 6: Execution & Process

‣ Trade Setups, Entries/Stops/Targets ‣ Trade Management & Position Sizing, Risk-Reward & Expectancy ‣ Trading Plan Construction + Use Case Class ‣ Backtesting & Journaling, Trade Reviews & Applied Concepts ‣ Trading Psychology + Capstone: Macro Thesis to Trade Execution Click to view the full 24-class breakdown

/0

6

Module 6: Execution & Process

‣ Trade Setups, Entries/Stops/Targets ‣ Trade Management & Position Sizing, Risk-Reward & Expectancy ‣ Trading Plan Construction + Use Case Class ‣ Backtesting & Journaling, Trade Reviews & Applied Concepts ‣ Trading Psychology + Capstone: Macro Thesis to Trade Execution Click to view the full 24-class breakdown

/0

6

Module 6: Execution & Process

‣ Trade Setups, Entries/Stops/Targets ‣ Trade Management & Position Sizing, Risk-Reward & Expectancy ‣ Trading Plan Construction + Use Case Class ‣ Backtesting & Journaling, Trade Reviews & Applied Concepts ‣ Trading Psychology + Capstone: Macro Thesis to Trade Execution Click to view the full 24-class breakdown

From The Founder

I’ve been trading for over 26 years, and teaching for more than a decade. This isn’t just a business — it’s personal, it's a passion, it’s about giving back. I still run my own trading firm, and I’m actively in the markets every day. I believe you can’t teach trading unless you’re still doing it at the highest level yourself. That’s the standard I hold myself to.

What makes our program different is that we don’t just tell you what to do. We focus on your development — we give you the tools, the structure, and the environment to truly grow as a trader. Our goal is to help you become independent — to develop your own ideas, to think for yourself, to navigate the ups and downs with clarity.

From The Founder

I’ve been trading for over 26 years, and teaching for more than a decade. This isn’t just a business — it’s personal, it's a passion, it’s about giving back. I still run my own trading firm, and I’m actively in the markets every day. I believe you can’t teach trading unless you’re still doing it at the highest level yourself. That’s the standard I hold myself to.

What makes our program different is that we don’t just tell you what to do. We focus on your development — we give you the tools, the structure, and the environment to truly grow as a trader. Our goal is to help you become independent — to develop your own ideas, to think for yourself, to navigate the ups and downs with clarity.

From The Founder

I’ve been trading for over 26 years, and teaching for more than a decade. This isn’t just a business — it’s personal, it's a passion, it’s about giving back. I still run my own trading firm, and I’m actively in the markets every day. I believe you can’t teach trading unless you’re still doing it at the highest level yourself. That’s the standard I hold myself to.

What makes our program different is that we don’t just tell you what to do. We focus on your development — we give you the tools, the structure, and the environment to truly grow as a trader. Our goal is to help you become independent — to develop your own ideas, to think for yourself, to navigate the ups and downs with clarity.

Marco Gomez

Founder & Head Trader

Enrollment & Next Steps

Spots: Only 20 – Secure Yours Before February 1st

Only 20 Spots:

Secure Yours Before December 1st

$3,250

1. 30-minute interview ✔

2. Submit you cover letter ✔

3. Join the IOTAF ✔

Get Funded. Get Hired.

After MIT Miami, two doors open:

1. Ocram Capital Funding

→ Top graduates trade real capital

→ Live on our Brickell floor, side-by-side with Marco Gomez

2. Job Placement Pipeline

→ Direct intros to hedge funds, prop firms, and bank

→ Alumni land roles at Societe Generale, JPMorgan, Goldman Sachs, and much more.

Only qualified applicants get this shot. Prove you belong, earn the seat & walk out with capital or a six-figure offer.

Frequently Asked Questions

We Answer All

Is the course online or in person?

Is the course online or in person?

Is the course online or in person?

Are there any prerequisites to enroll?

Are there any prerequisites to enroll?

Are there any prerequisites to enroll?

How long does the program take to complete?

How long does the program take to complete?

How long does the program take to complete?

What’s the cost of the program?

What’s the cost of the program?

What’s the cost of the program?

Do you offer a payment plan?

Do you offer a payment plan?

Do you offer a payment plan?

What does the program include?

What does the program include?

What does the program include?

When does the next program start?

When does the next program start?

When does the next program start?

Is there an opportunity to get funded after completing the program?

Is there an opportunity to get funded after completing the program?

Is there an opportunity to get funded after completing the program?

Can this program help me get a job in finance?

Can this program help me get a job in finance?

Can this program help me get a job in finance?

How much capital do I need to start trading?

How much capital do I need to start trading?

How much capital do I need to start trading?

Can I keep my AGORA access after the program ends?

Can I keep my AGORA access after the program ends?

Can I keep my AGORA access after the program ends?

More Questions?